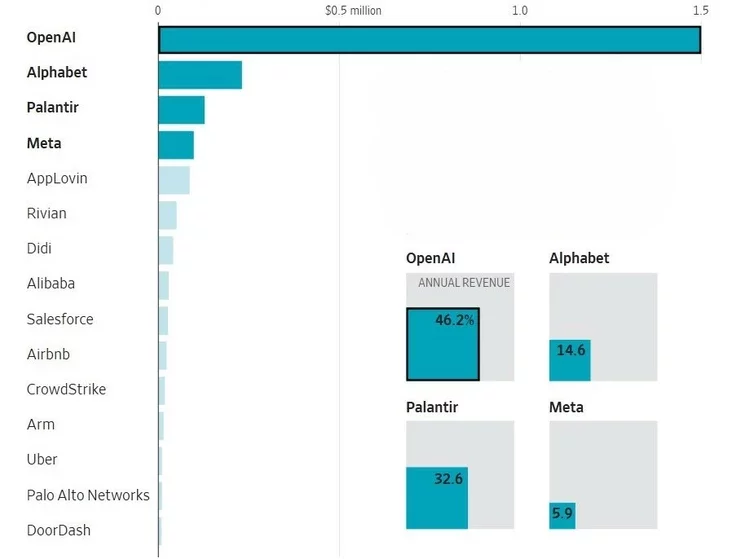

Stock-based compensation averages about $1.5 million per employee across a workforce of roughly 4,000 people.

-

This level is more than seven times higher than the equity compensation Google disclosed in 2003, the year before it filed for its IPO in 2004.

-

The $1.5 million figure is also about 34 times higher than the average employee compensation at 18 other major technology companies in the year before they went public, according to The Wall Street Journal’s analysis of data compiled by Equilar.

The analysis reviewed major technology IPOs over the past 25 years.

To maintain its lead in the AI race, OpenAI has been granting massive equity packages to top researchers and engineers, turning many of them into some of the wealthiest employees in Silicon Valley. These equity awards significantly increase the company’s operating losses and rapidly dilute existing shareholders.

As the AI arms race intensified over the summer, leading labs such as OpenAI came under pressure to raise pay after Meta Platforms CEO Mark Zuckerberg began offering compensation packages worth hundreds of millions of dollars—and in rare cases up to $1 billion—to senior executives and researchers at rival firms.

Zuckerberg’s recruiting push led more than 20 OpenAI employees to join Meta, including Shengjia Zhao, a co-creator of ChatGPT. In August, OpenAI paid one-time bonuses to some research and engineering staff, with several employees receiving payouts worth millions of dollars.

Financial data shared with investors this summer indicate that OpenAI’s stock-based compensation is expected to increase by roughly $3 billion per year through 2030.

The company recently informed employees that it will eliminate a policy requiring them to work at OpenAI for at least six months before their equity begins to vest, a change that could further increase compensation levels.

OpenAI’s stock-based compensation is expected to reach 46% of revenue in 2025, the highest ratio among all 18 companies analyzed, with the exception of Rivian, which generated no revenue in the year before its IPO.

For comparison, Palantir’s stock-based compensation equaled 33% of revenue in the year before its 2020 IPO, Google’s was 15%, and Facebook’s was 6%. On average, according to Equilar data, stock-based compensation accounted for about 6% of revenue among technology companies in the year prior to going public.

OpenAI’s compensation model underscores how the AI race has shifted from software innovation to a full-scale talent war. While outsized equity grants help secure top researchers in the short term, the growing dilution, rising losses, and heavy infrastructure commitments suggest that long-term sustainability will depend less on paying for brilliance and more on translating it into durable, profitable platforms.

ES

ES  EN

EN