After explosive growth in 2024, the decentralized physical infrastructure (DePIN) sector failed to repeat its success. Stagnation intensified in the second half of 2025 along with the broader crypto industry.

Despite the correction in market capitalization, notable structural changes took place within the sector. Investors began favoring more mature teams capable of scaling products and generating real revenue. Additional momentum for the niche came from recurring outages among centralized providers such as Cloudflare, growing demand for AI model and robotics training, and increasing regulatory clarity.

In a new report, ForkLog examined how companies are being forced to transform in order to increase profitability and which DePIN segments could gain strength in 2026.

Revenue Comes First

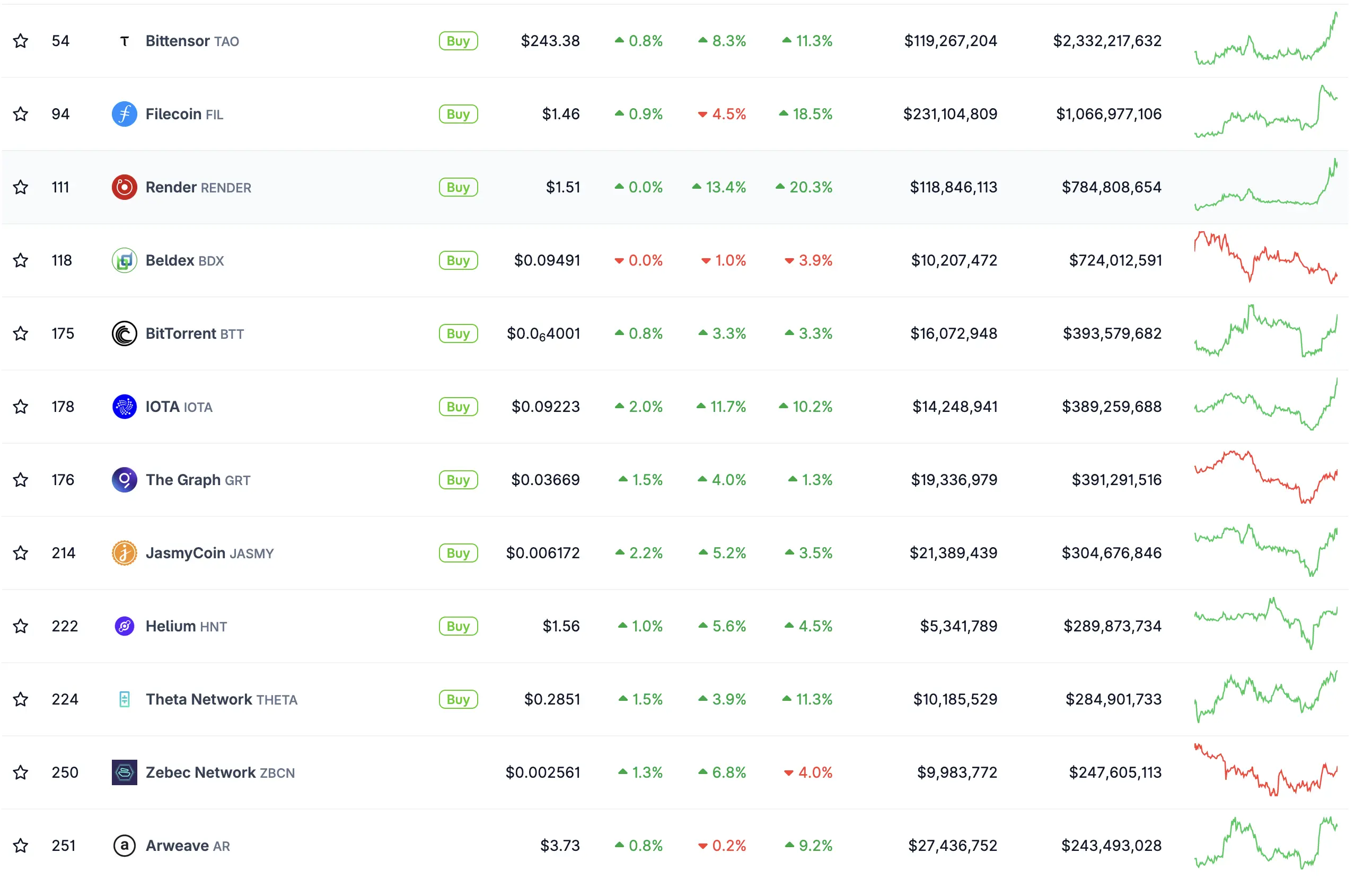

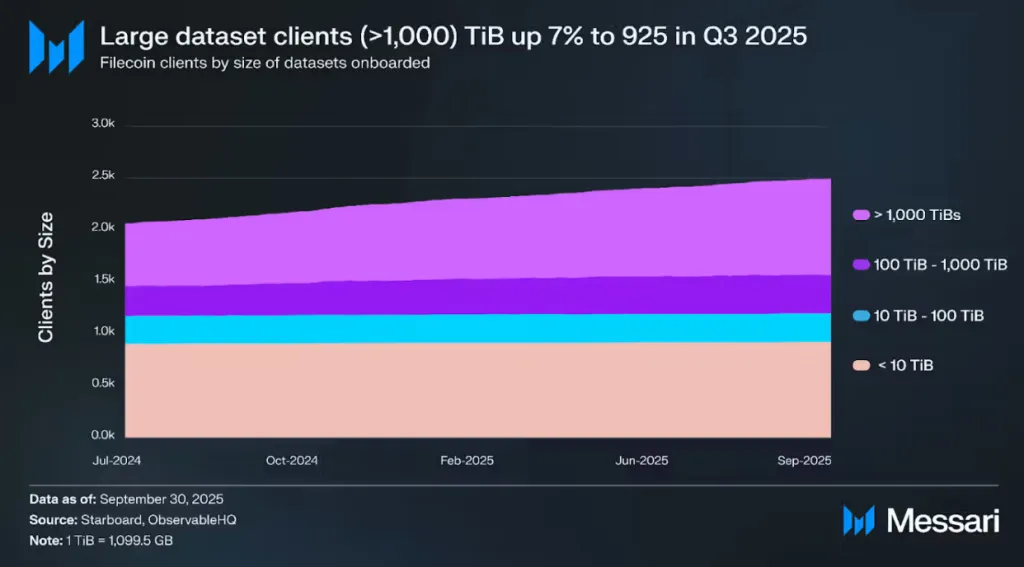

In 2024, excitement around DePIN was driven by the first visible successes of startups, growth in user bases, and rising token prices. The sector also benefited from the AI boom, as DePIN became an alternative source of infrastructure—providing GPU compute and data generation. However, according to a Messari report, the segment lost around 56% of its value in 2025.

The correction exposed weaknesses in infrastructure companies and highlighted the shortcomings of valuing the industry primarily through technical analysis and market capitalization.

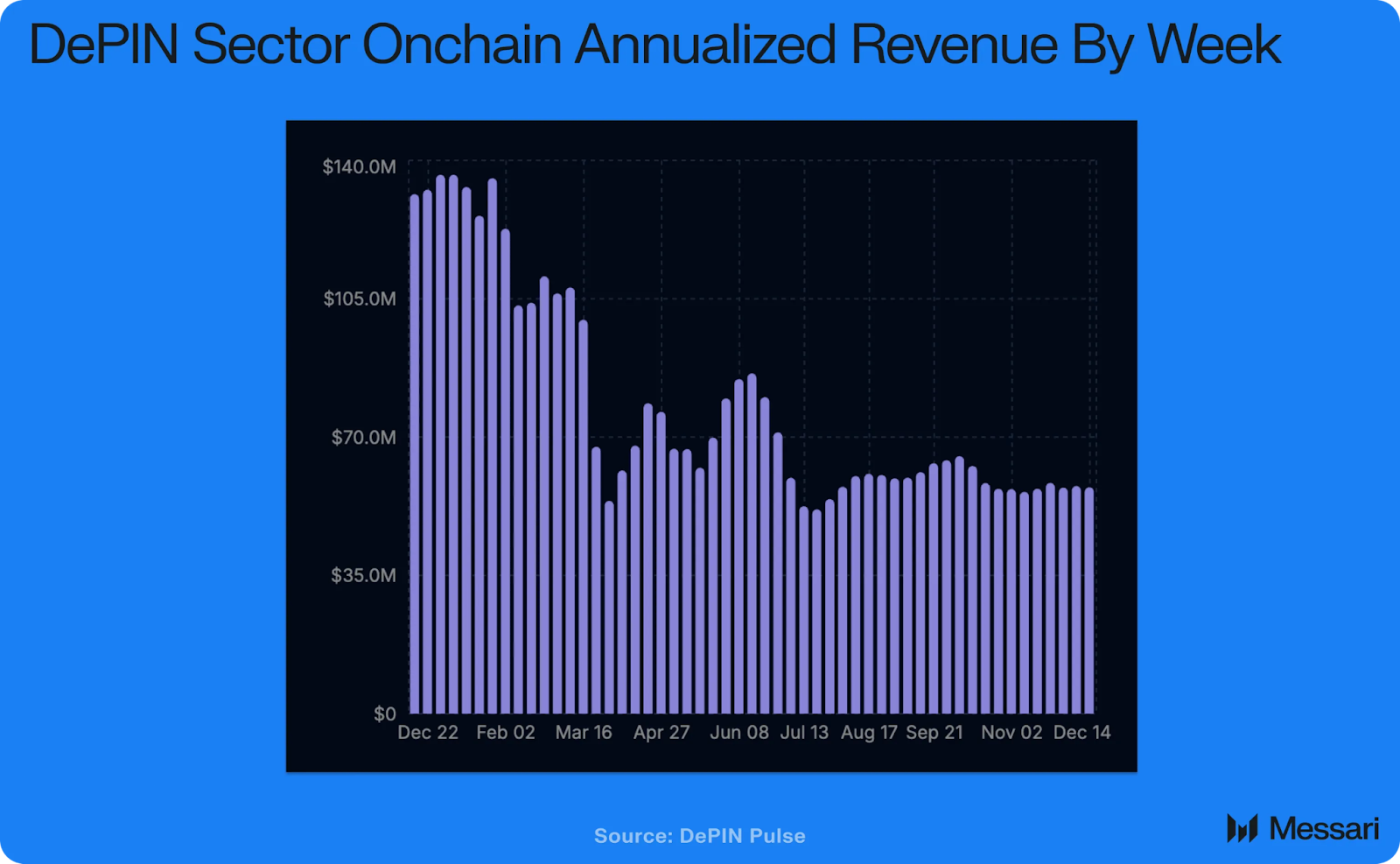

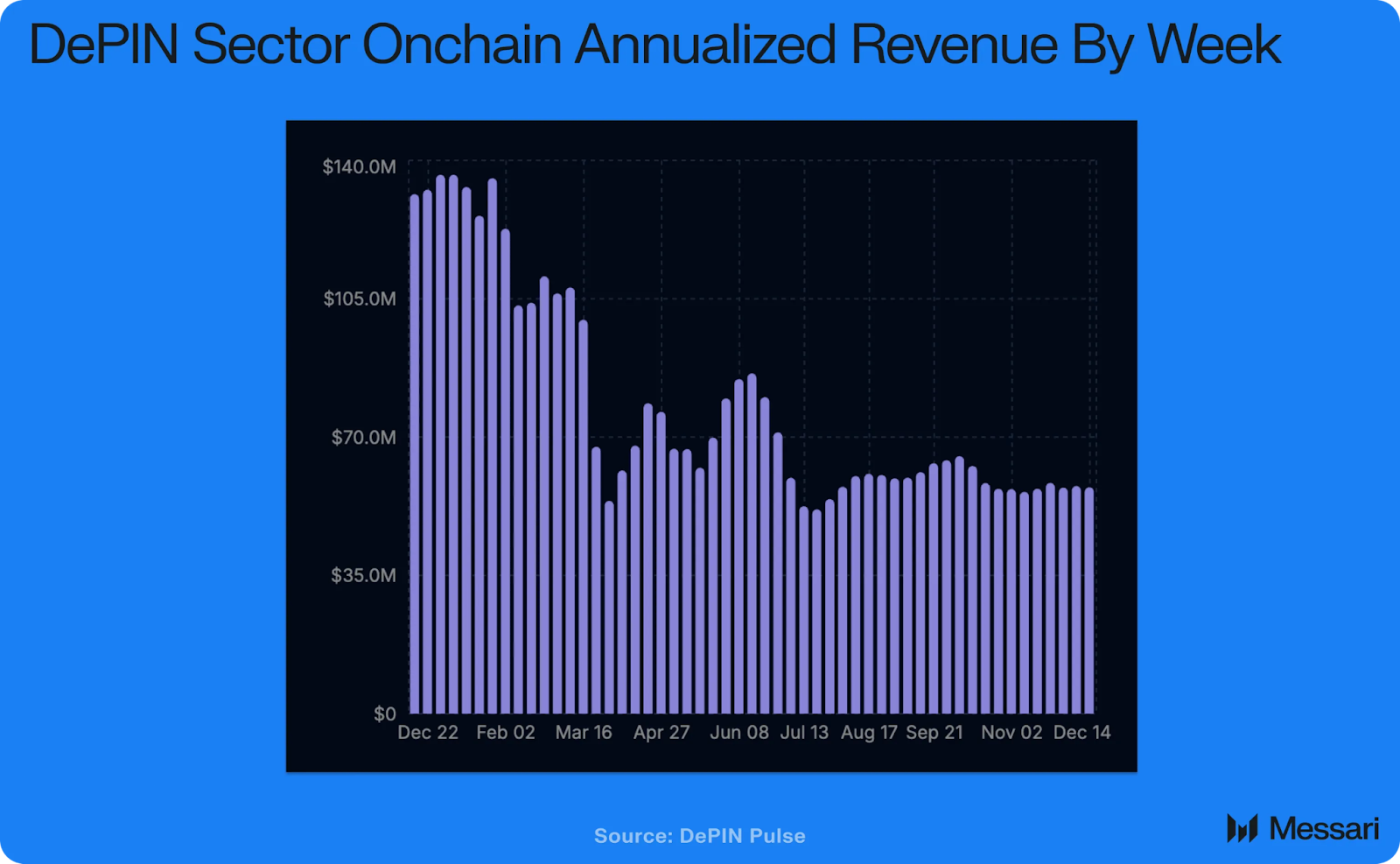

Speculative asset-based analytics masked fundamental changes in the sector. At the peak of the cycle, analysts confidently projected revenue growth to $150 million in 2025. In their view, this “likely happened,” but verifying the figure is nearly impossible due to the nature of the business and accounting practices. Revenue is often calculated off-chain and bundled with services only indirectly related to DePIN.

The market downturn forced a more professional reassessment of the niche—without focusing on token price noise or bold team statements. On-chain revenue became one of the key elements in DePIN’s transformation in 2025.

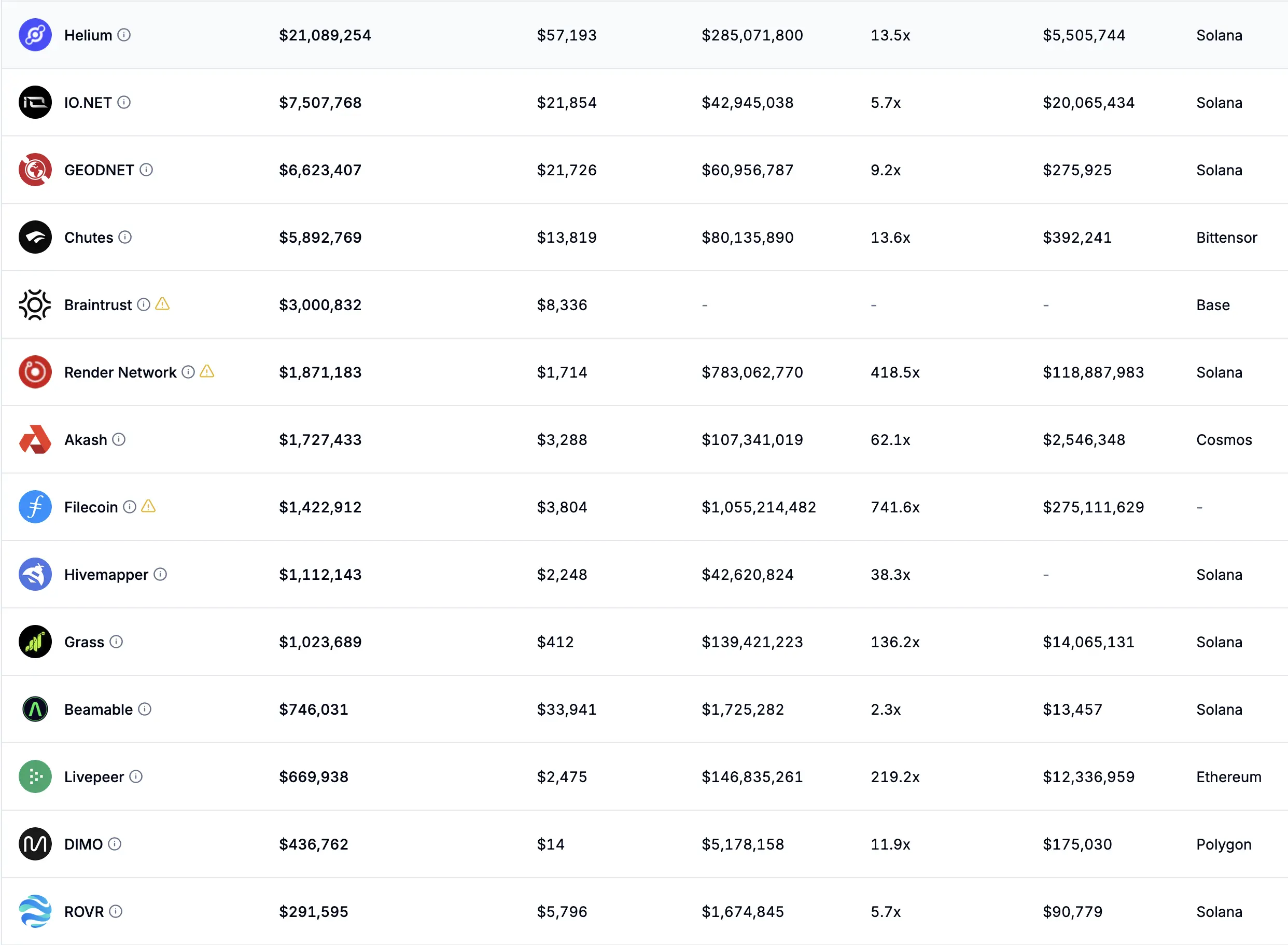

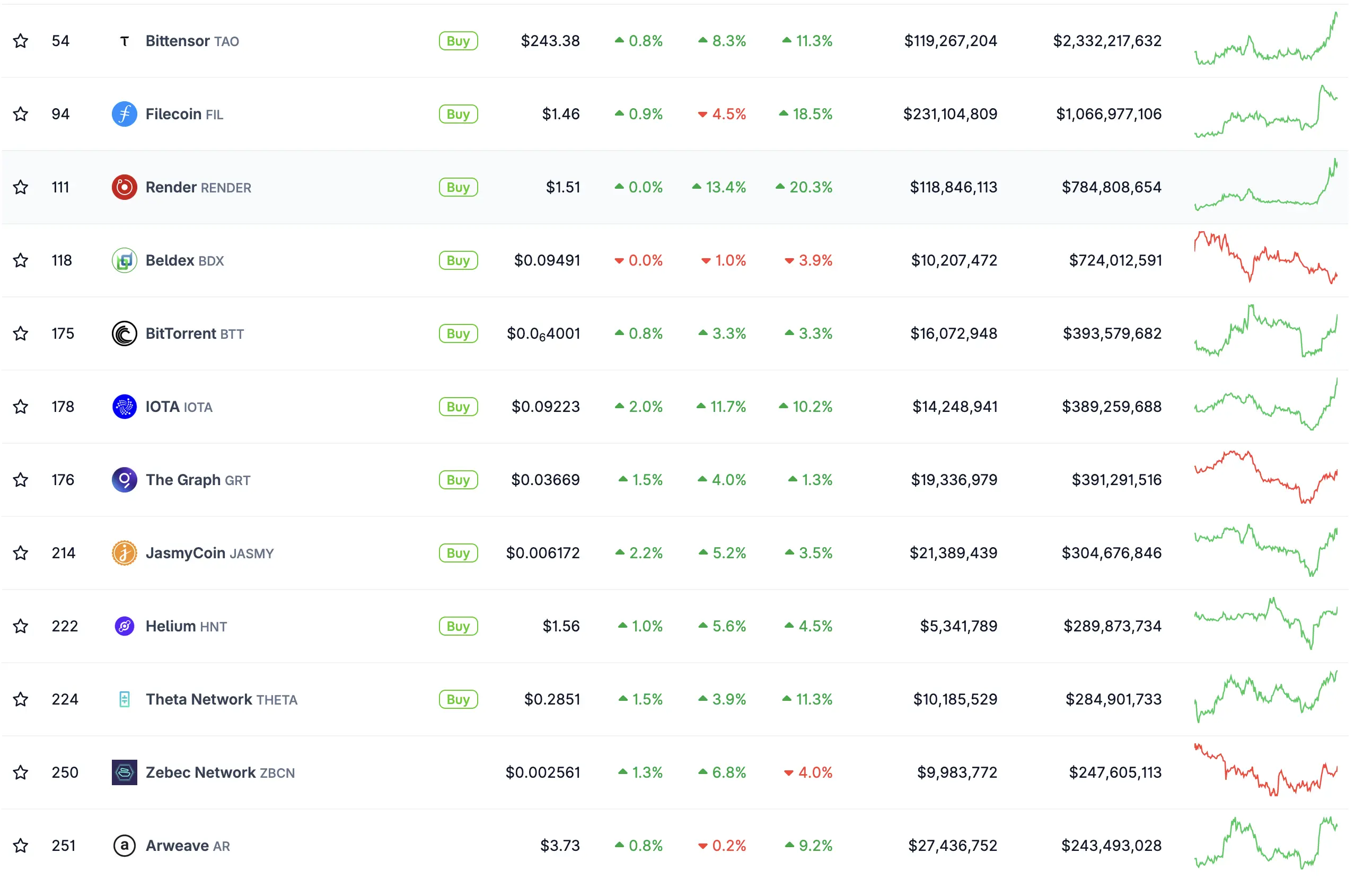

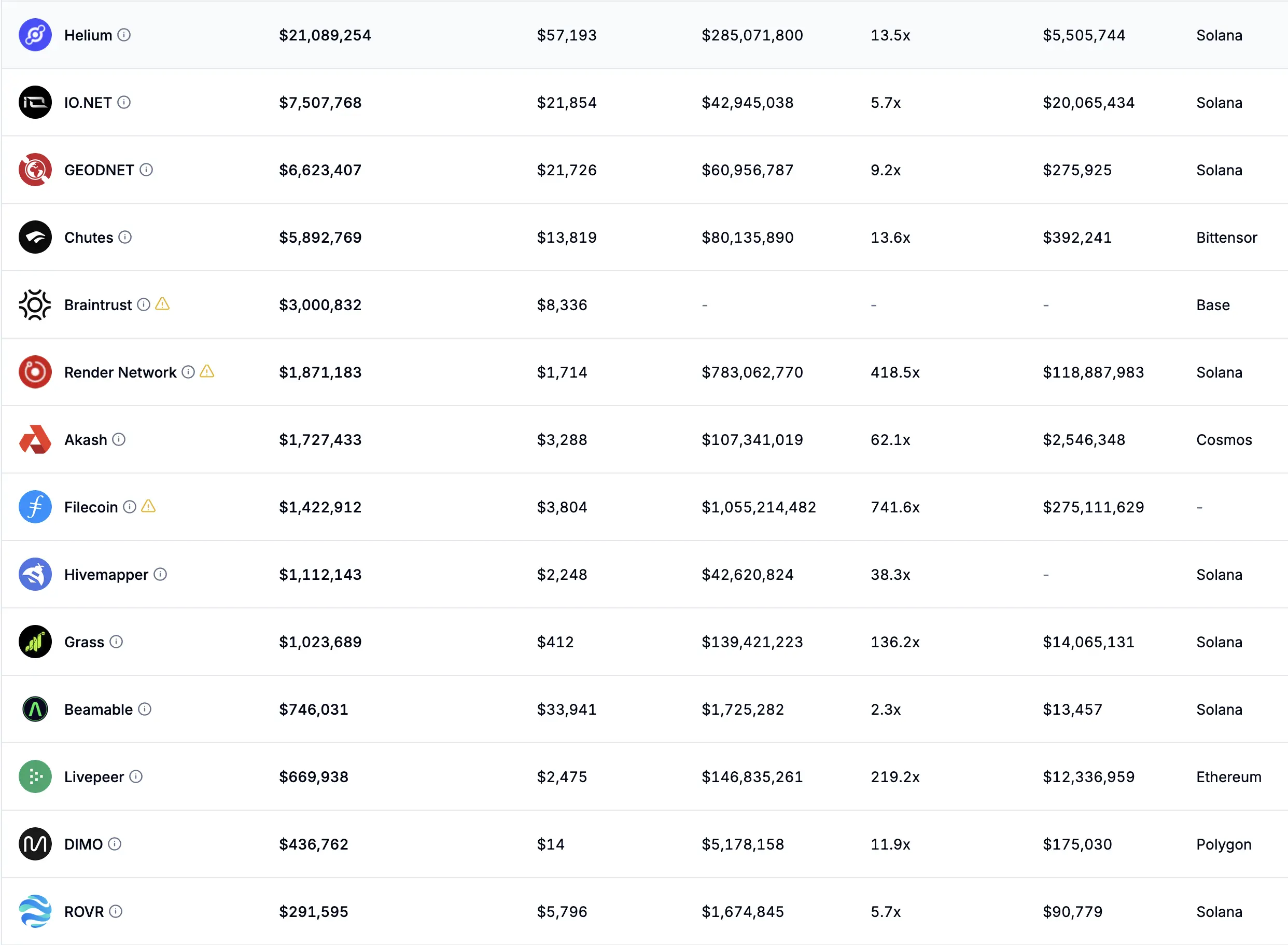

Although tokens of strong projects such as cloud computing platform Akash, cellular network Helium, and geospatial sensor network Geodnet declined over the year, their teams managed to demonstrate solid revenue growth. According to Messari, this creates a more attractive entry point for investors and could meaningfully impact results in 2026.

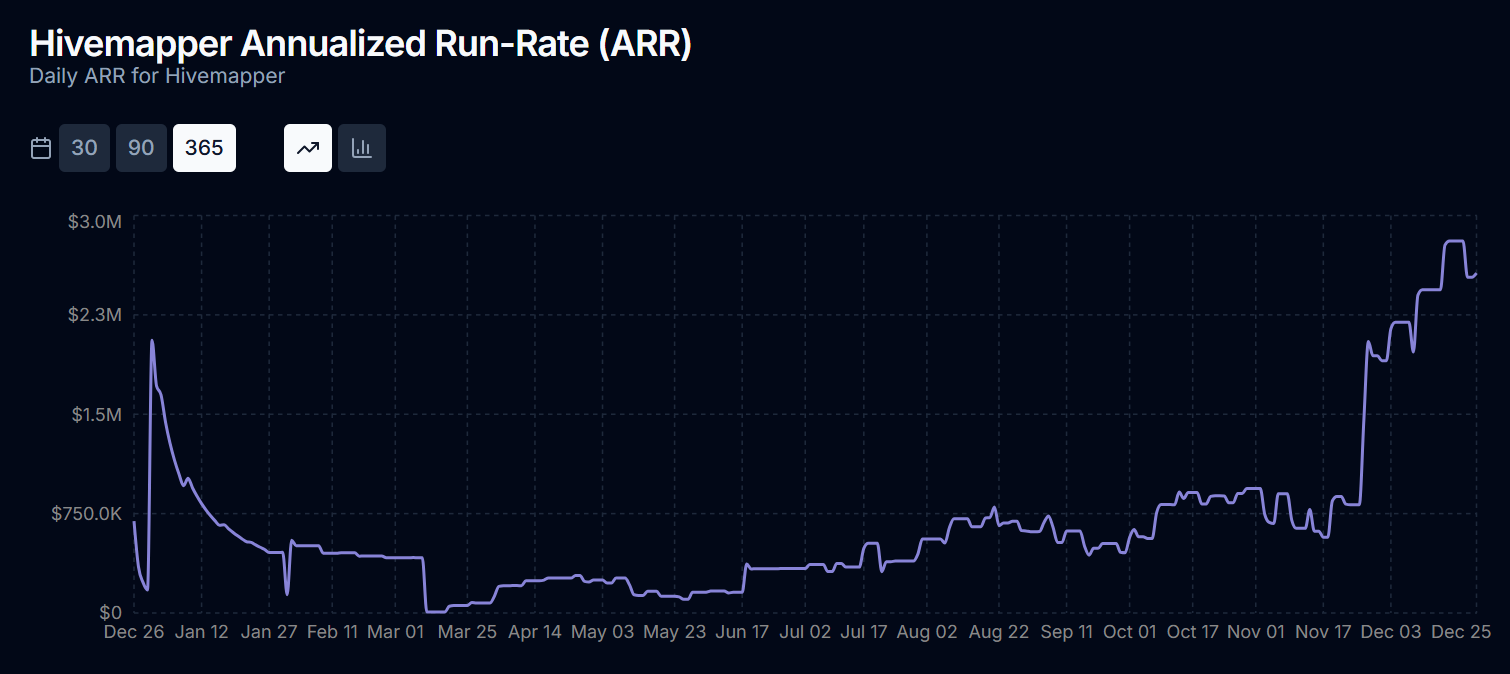

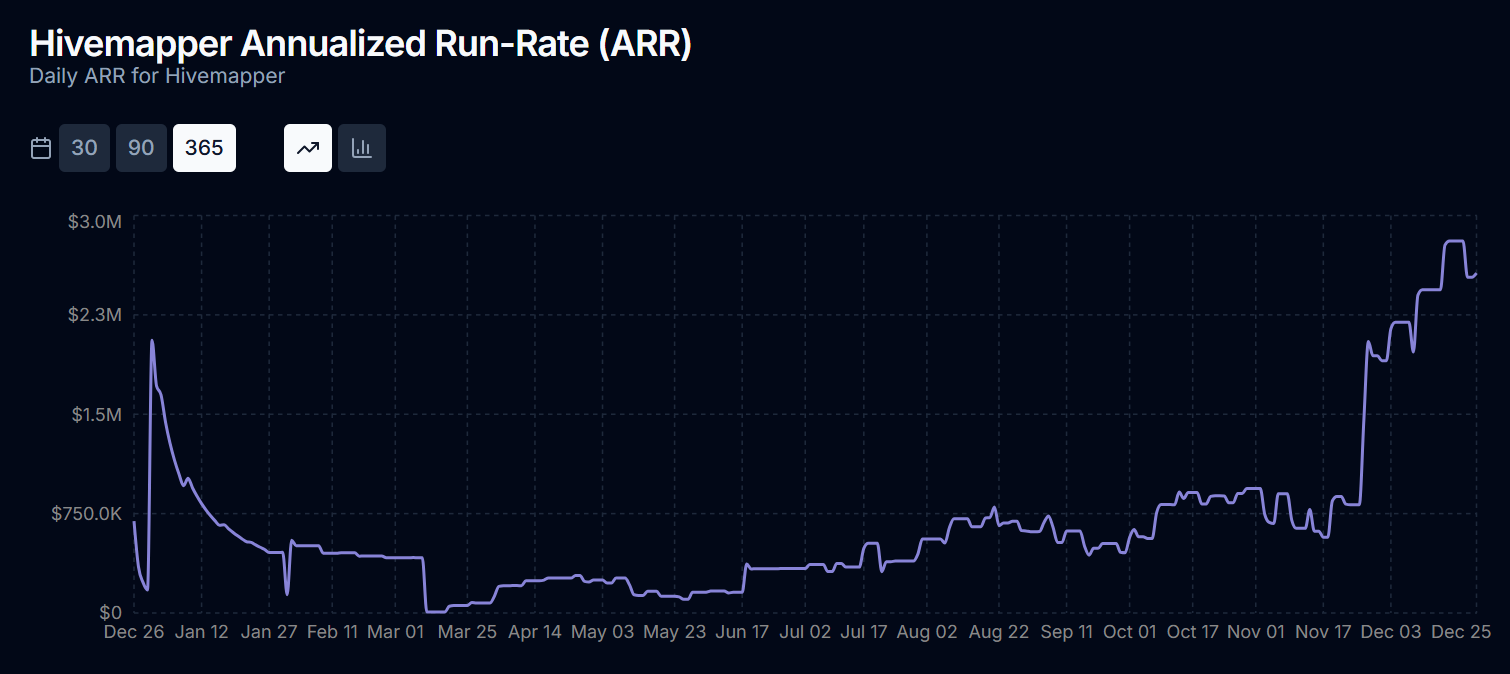

According to DePIN Pulse, from August to November 2025 the ARR of decentralized Google Maps alternative Hivemapper grew from $500,000 to approximately $3 million. On December 29, the project’s 30-day ARR exceeded $1.3 million.

An active reorganization that began in 2024 allowed Hivemapper to adopt a Map Improvement Proposal (MIP). It introduced a customer-centric approach to meeting demand for mapping data and increased map update speed—critical for certain buyer categories.

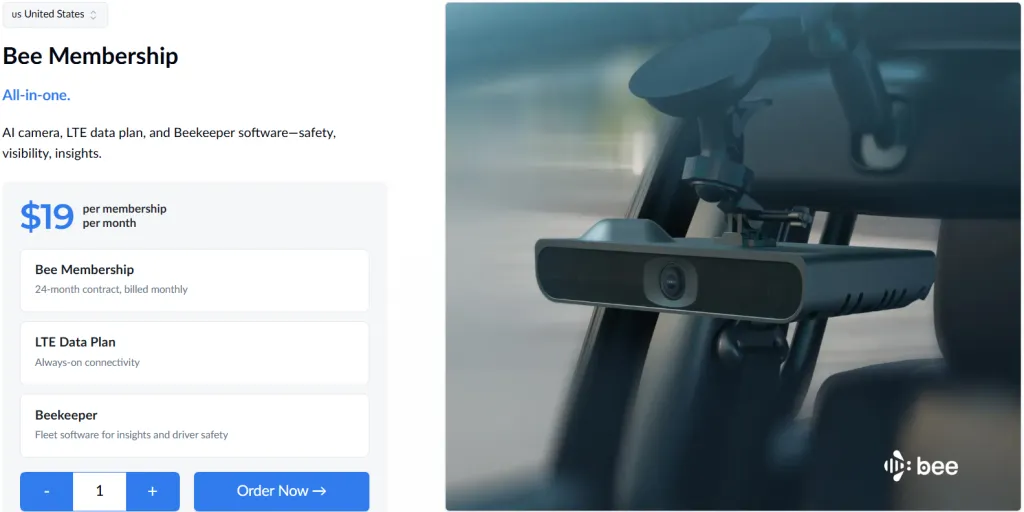

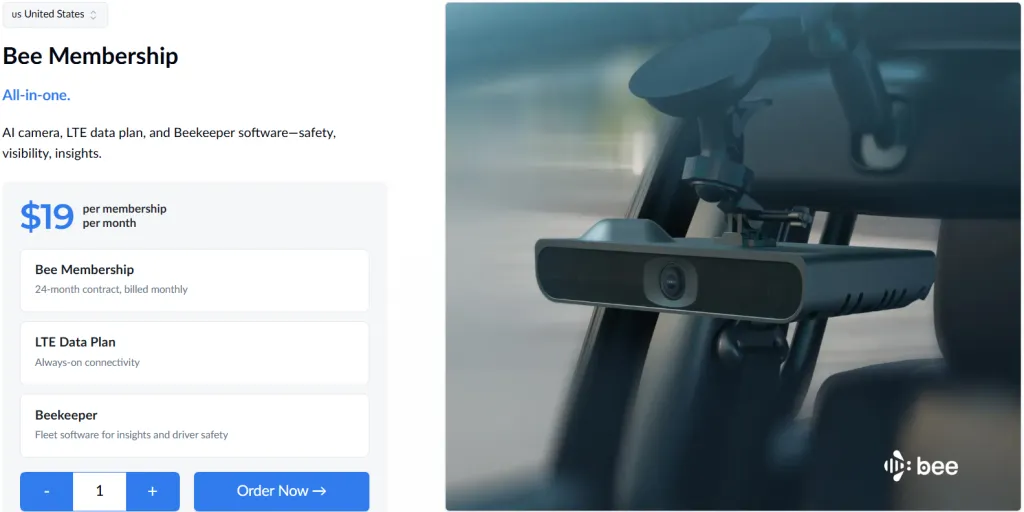

The startup also lowered the entry barrier for data providers—drivers who record roads using Bee devices. Renting the required hardware, software, and membership now costs $19 per month.

Investors backed these changes. In the same month, Bee Maps raised $32 million in a funding round led by Pantera Capital, LDA Capital, Borderless Capital, and Ajna Capital.

According to Messari, DePIN’s projected annual revenue in 2026 could double and exceed $100 million.

Key growth drivers include:

-

new TGEs from projects like DAWN, BitRobot, and Daylight that account for on-chain revenue more accurately and improve transparency;

-

expansion of established, profitable networks.

Scaling and the Demand Problem

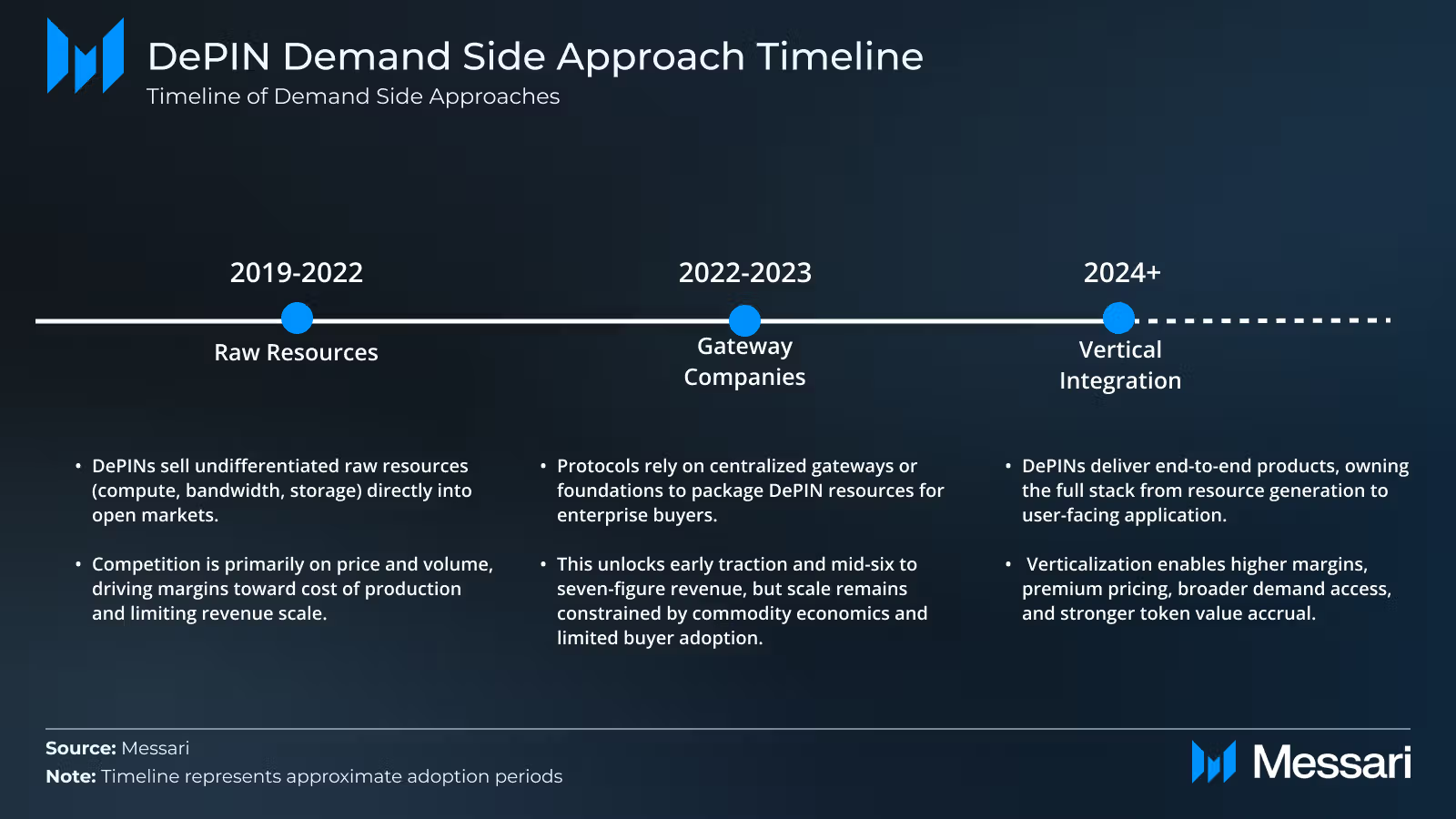

Early DePIN pioneers assumed that surplus community-provided hardware would allow networks to compete primarily on price—offering cheaper GPU compute, bandwidth, and storage with performance advantages such as low latency. In practice, generated revenue remained modest.

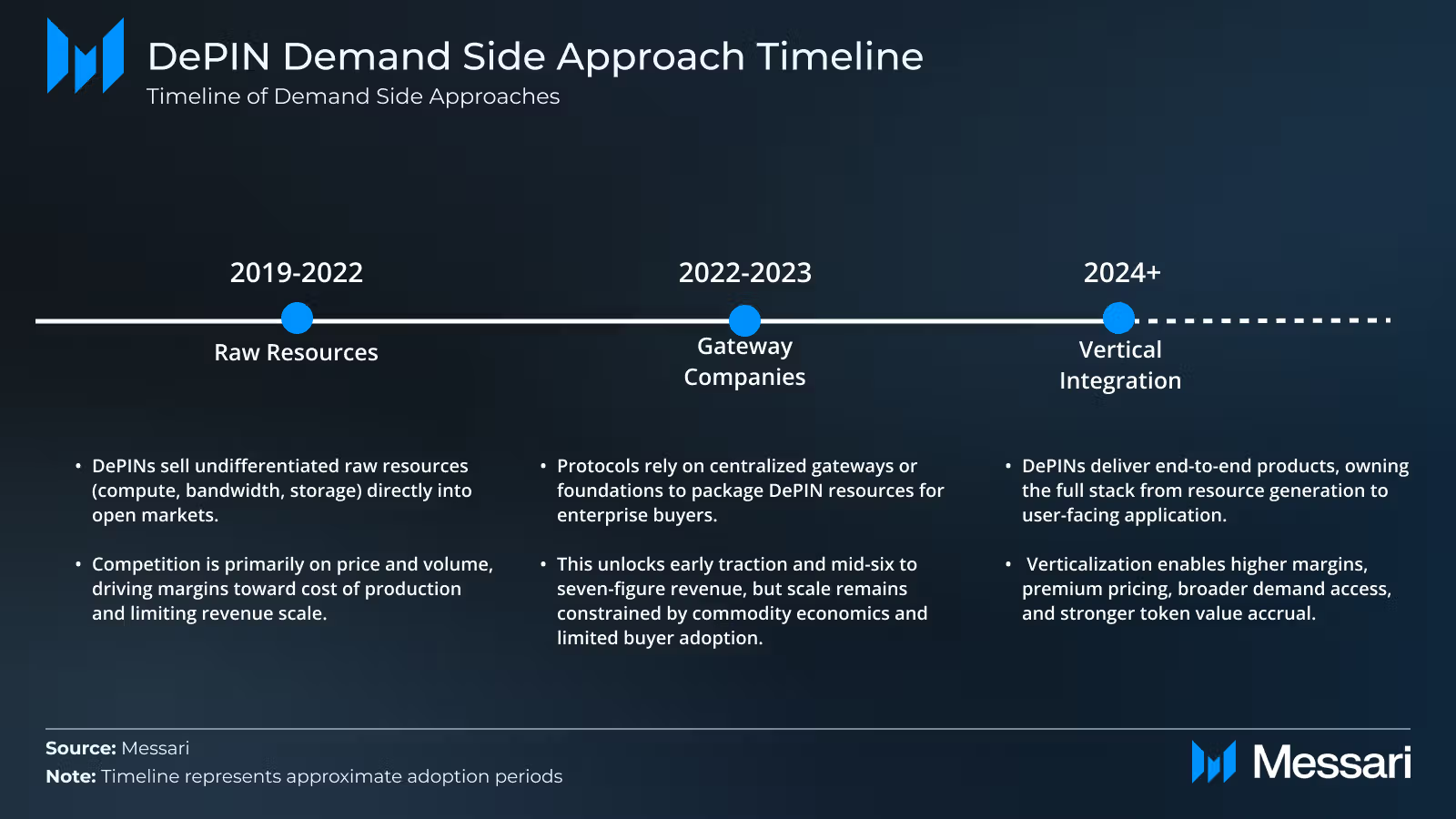

Most DePIN networks effectively produce commodity resources, for which establishing sustainable distribution channels has proven difficult. According to Messari analysts, the most profitable models will be those that integrate production into full-stack, end-user solutions—changing their business approach, as Hivemapper did.

In 2022–2023, some DePIN teams assumed the issue was insufficient sales and marketing support. As a result, certain protocols created subsidiaries and funds. This approach proved effective only for generating initial revenue.

Analysts believe the deeper issue lies in the nature of commodity businesses: low margins and intense competition require minimal pricing and large volumes—something the DePIN sector has struggled to achieve.

Potential solutions include:

-

moving into higher-margin products with premium pricing;

-

expanding the customer base with direct access to end users;

-

reducing the need for aggressive price dumping;

-

strengthening long-term token value by linking it to multiple higher-value economic activities;

-

building tight feedback loops between users and networks to better match demand.

According to DePIN Pulse, Helium Mobile was the undisputed revenue leader in 2025. Its 30-day ARR approached $21 million in December, with daily revenue of $60,666 on December 29.

Experts attribute Helium Mobile’s success primarily to vertical integration.

Instead of selling bandwidth as a generic commodity, Helium Mobile launched a complete consumer product—combining hotspots into a mobile coverage network. The company manages the entire customer lifecycle, from device activation and billing to SIM cards and support.

This approach reshaped Helium’s economics. According to Messari, the mobile segment accounts for 53% of HNT token burns and internal Data Credits (DC) usage.

To maintain a deflationary model, Helium Mobile burns 100% of subscription revenue from its $15 and $30 monthly plans. While Helium Mobile Offload burns less HNT in dollar terms than similar centralized operations, the virtual mobile operator generates higher overall revenue.

On December 8, Helium Mobile Offload burned $6,700 worth of HNT, compared to $201,377 from carrier offload. Rather than competing for B2B bandwidth sales, Helium captures higher margins through a B2C model.

Rapid user growth alongside a steady increase in installed nodes confirms the company’s success.

As of December 29, 2025, Helium reported 622,000 registrations across 121,000 access points.

Optimism was further boosted when the SEC closed its investigation into Helium developer Nova Labs in April.

In December, Helium announced a partnership with Mambo WiFi to expand internet access across Brazil. Mambo’s network of over 40,000 access points will significantly extend Helium’s reach in a country with uneven connectivity.

Energy and AI Drive the Next Phase

The push toward creating differentiated products is becoming a new DePIN narrative.

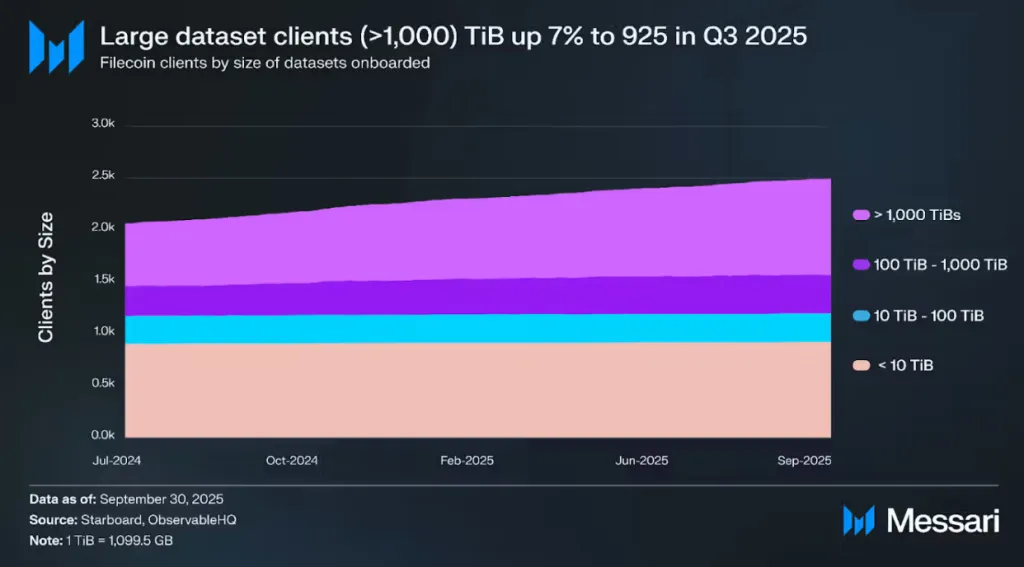

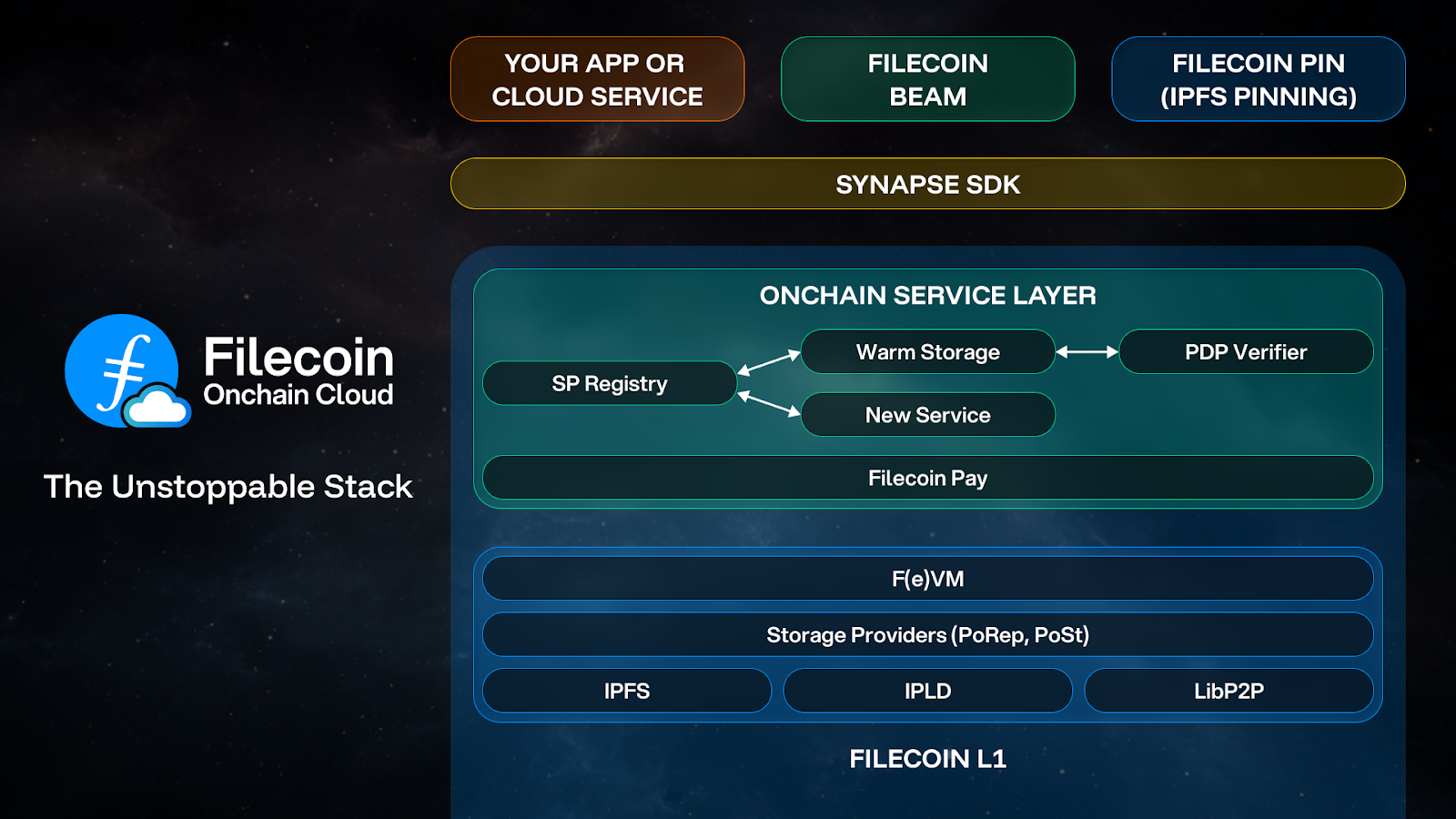

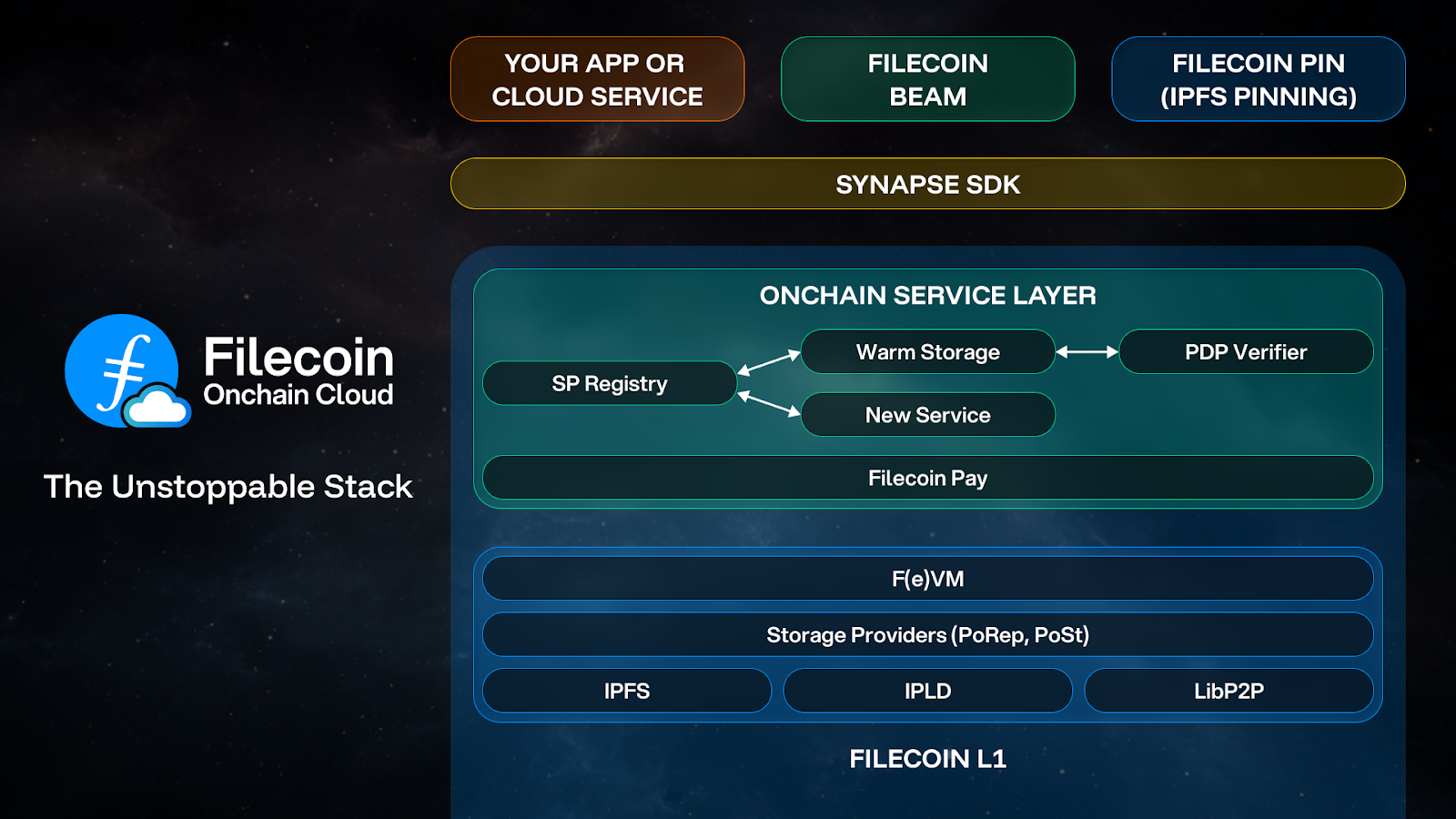

One sector pioneer is Filecoin, the market cap leader at around $1 billion. Initially positioned as a decentralized cloud storage alternative, Filecoin announced Filecoin Onchain Cloud in November 2025—competing with Cloudflare and AWS.

The platform expands Filecoin’s capabilities, particularly in AI—integrating storage, data retrieval, and on-chain payments via Filecoin Beam and Filecoin Pay.

Amid recurring outages at centralized providers like AWS, DePIN’s evolution may attract renewed user and investor attention.

On November 18, 2025, during the latest Cloudflare incident, trading volumes in DePIN tokens surged 25–40% on average. Activity increased in FIL/USDT, AR/USDT, and GRASS/USDT pairs on Binance and Bybit.

Although volatility was short-lived, it signaled growing recognition of decentralized infrastructure’s value.

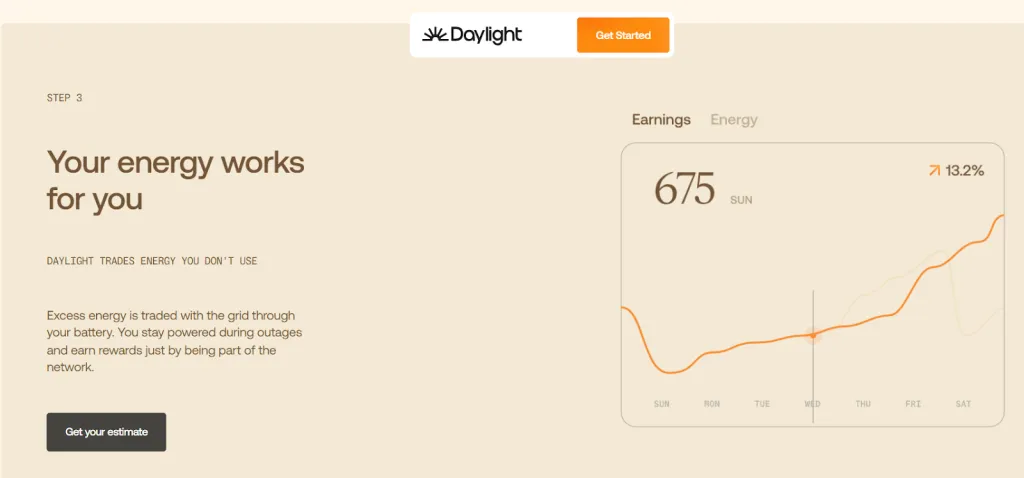

The shift toward enterprise clients is also evident in decentralized energy networks such as Daylight and Fuse Energy, which are building vertically integrated models.

Daylight focuses on renewable energy, installing solar panels and batteries while incentivizing users through future token rewards.

The startup connects distributed energy resources, accesses energy and data via its network, and sells differentiated energy products to buyers. In October, Daylight raised $75 million in funding led by Framework Ventures.

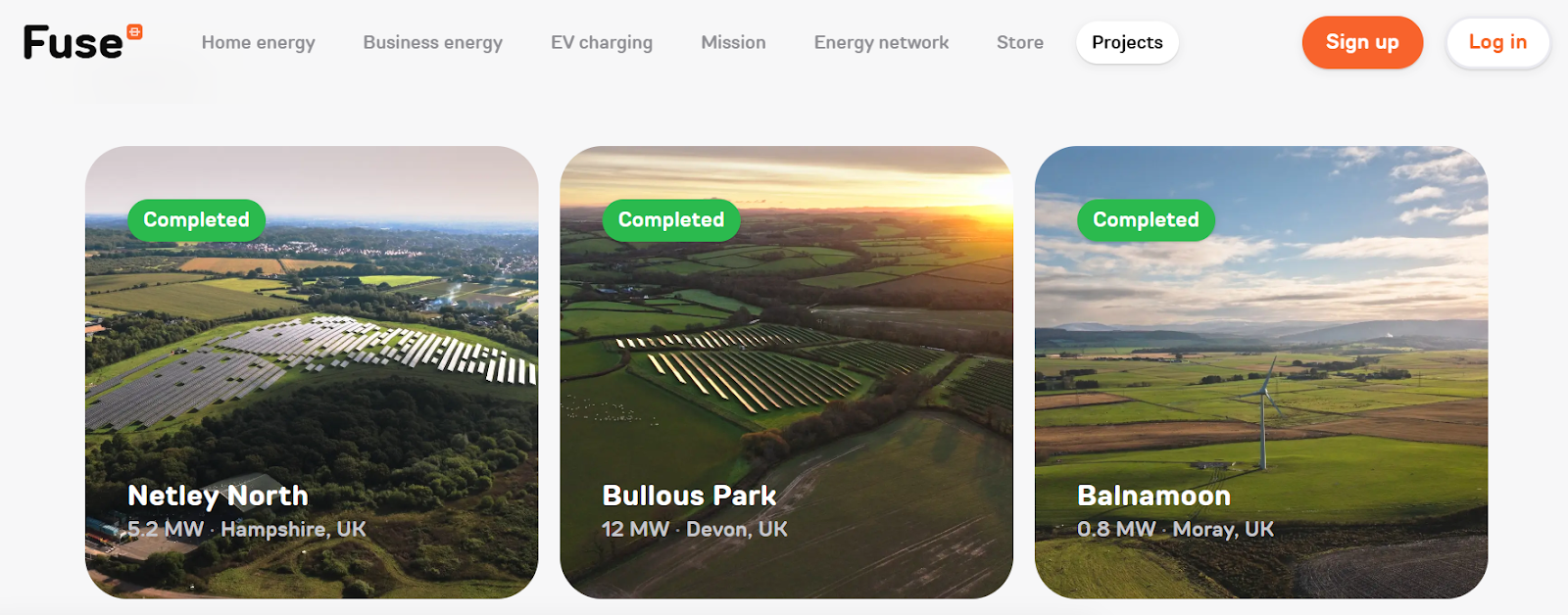

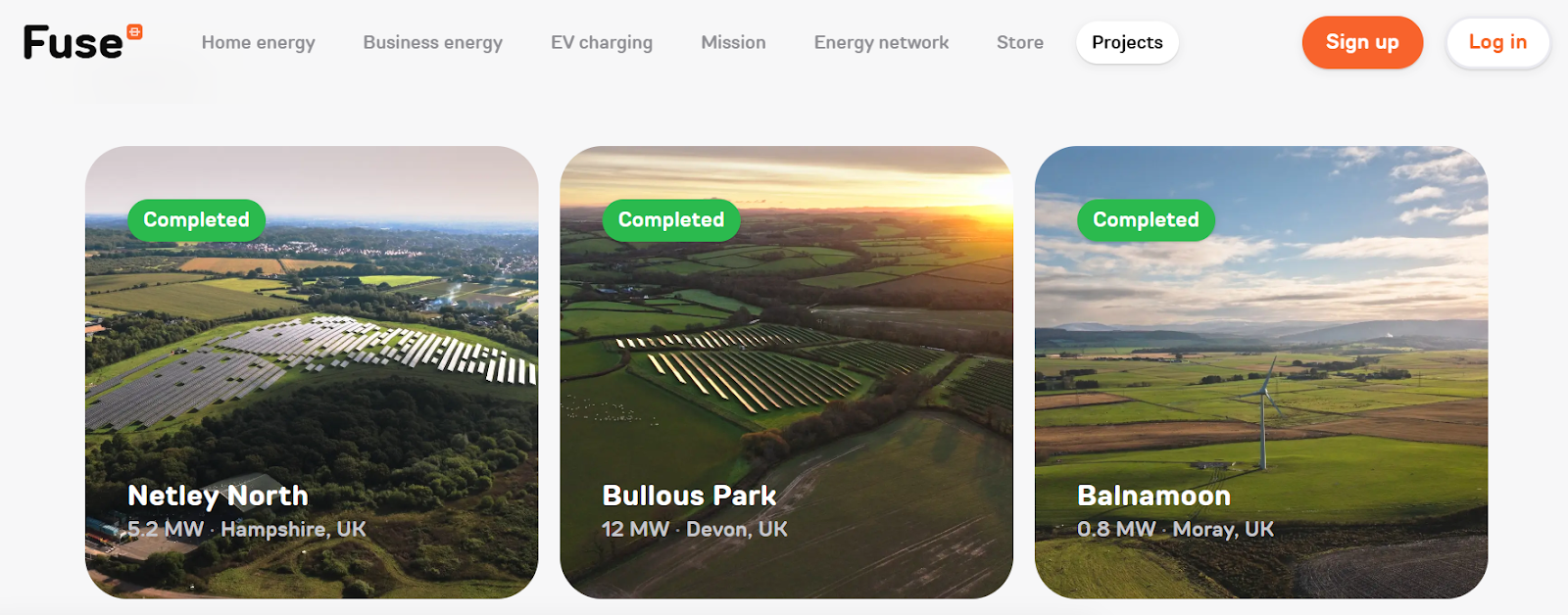

Another major player, Fuse Energy, operates across generation, retail sales, and virtual power plants within a unified system. Instead of selling capacity and data to third parties, Fuse manages its own ENERGY network to aggregate supply.

By using token incentives, Fuse significantly increases accessible flexible capacity while lowering acquisition costs—funding customer discounts and ecosystem rewards.

According to DePINscan, Fuse raised $70 million in a Series B round led by Lowercarbon Capital and Balderton Capital, valuing the company at $5 billion.

DePAI: The AI Opportunity

Messari analysts believe DePIN’s biggest opportunity lies in AI—specifically decentralized AI infrastructure, or DePAI.

While many solutions remain years away from enterprise-scale adoption, real-world data collection for robotics already has economic value. AI companies are willing to pay for:

-

navigation data;

-

video streams;

-

3D maps;

-

sensor logs;

-

telematics;

-

geospatial signals.

DePAI data-collection protocols can fill gaps in these areas, enabling near-term monetization.

Some existing DePIN networks already generate real revenue from data sales:

-

DIMO — vehicle telematics data;

-

Geodnet — geodetic sensor data;

-

ROVR — drone imagery and aerial photography.

These networks sell data directly to industries intersecting with physical AI training—mapping, navigation, geolocation, autonomous driving, simulation, and world modeling.

The next evolution stage is DePAI networks purpose-built for robotics-grade data capture and embodied AI training.

Three emerging projects stand out:

-

BitRobot — a decentralized embodied AI and robotics research platform on Solana;

-

PrismaX — a protocol aggregating high-quality multimodal interaction data and robotic sensor inputs for LLMs;

-

Poseidon — a full-stack data network focused on IP-clean, high-quality datasets with built-in consent, licensing, and provenance.

According to Messari, in 2025 DePIN occupied an uncomfortable middle ground for investors. Narrative-driven traders lost interest, while fundamental investors viewed price-to-sales multiples as excessive.

Still, improved transparency, sector development, regulatory easing, and token sell-offs could attract investor attention in 2026.

In this new environment, DePIN is well-positioned for its next evolutionary phase. Its defining traits—real-world utility, observable demand, and growing revenue—align closely with broader market direction. The open question remains execution: can DePIN networks continue scaling revenue and grow into large, durable businesses?

After explosive growth in 2024, the decentralized physical infrastructure (DePIN) sector failed to repeat its success. Stagnation intensified in the second half of 2025 along with the broader crypto industry.

Despite the correction in market capitalization, notable structural changes took place within the sector. Investors began favoring more mature teams capable of scaling products and generating real revenue. Additional momentum for the niche came from recurring outages among centralized providers such as Cloudflare, growing demand for AI model and robotics training, and increasing regulatory clarity.

In a new report, ForkLog examined how companies are being forced to transform in order to increase profitability and which DePIN segments could gain strength in 2026.

Revenue Comes First

In 2024, excitement around DePIN was driven by the first visible successes of startups, growth in user bases, and rising token prices. The sector also benefited from the AI boom, as DePIN became an alternative source of infrastructure—providing GPU compute and data generation. However, according to a Messari report, the segment lost around 56% of its value in 2025.

The correction exposed weaknesses in infrastructure companies and highlighted the shortcomings of valuing the industry primarily through technical analysis and market capitalization.

Speculative asset-based analytics masked fundamental changes in the sector. At the peak of the cycle, analysts confidently projected revenue growth to $150 million in 2025. In their view, this “likely happened,” but verifying the figure is nearly impossible due to the nature of the business and accounting practices. Revenue is often calculated off-chain and bundled with services only indirectly related to DePIN.

The market downturn forced a more professional reassessment of the niche—without focusing on token price noise or bold team statements. On-chain revenue became one of the key elements in DePIN’s transformation in 2025.

Although tokens of strong projects such as cloud computing platform Akash, cellular network Helium, and geospatial sensor network Geodnet declined over the year, their teams managed to demonstrate solid revenue growth. According to Messari, this creates a more attractive entry point for investors and could meaningfully impact results in 2026.

According to DePIN Pulse, from August to November 2025 the ARR of decentralized Google Maps alternative Hivemapper grew from $500,000 to approximately $3 million. On December 29, the project’s 30-day ARR exceeded $1.3 million.

An active reorganization that began in 2024 allowed Hivemapper to adopt a Map Improvement Proposal (MIP). It introduced a customer-centric approach to meeting demand for mapping data and increased map update speed—critical for certain buyer categories.

The startup also lowered the entry barrier for data providers—drivers who record roads using Bee devices. Renting the required hardware, software, and membership now costs $19 per month.

Investors backed these changes. In the same month, Bee Maps raised $32 million in a funding round led by Pantera Capital, LDA Capital, Borderless Capital, and Ajna Capital.

According to Messari, DePIN’s projected annual revenue in 2026 could double and exceed $100 million.

Key growth drivers include:

-

new TGEs from projects like DAWN, BitRobot, and Daylight that account for on-chain revenue more accurately and improve transparency;

-

expansion of established, profitable networks.

Scaling and the Demand Problem

Early DePIN pioneers assumed that surplus community-provided hardware would allow networks to compete primarily on price—offering cheaper GPU compute, bandwidth, and storage with performance advantages such as low latency. In practice, generated revenue remained modest.

Most DePIN networks effectively produce commodity resources, for which establishing sustainable distribution channels has proven difficult. According to Messari analysts, the most profitable models will be those that integrate production into full-stack, end-user solutions—changing their business approach, as Hivemapper did.

In 2022–2023, some DePIN teams assumed the issue was insufficient sales and marketing support. As a result, certain protocols created subsidiaries and funds. This approach proved effective only for generating initial revenue.

Analysts believe the deeper issue lies in the nature of commodity businesses: low margins and intense competition require minimal pricing and large volumes—something the DePIN sector has struggled to achieve.

Potential solutions include:

-

moving into higher-margin products with premium pricing;

-

expanding the customer base with direct access to end users;

-

reducing the need for aggressive price dumping;

-

strengthening long-term token value by linking it to multiple higher-value economic activities;

-

building tight feedback loops between users and networks to better match demand.

According to DePIN Pulse, Helium Mobile was the undisputed revenue leader in 2025. Its 30-day ARR approached $21 million in December, with daily revenue of $60,666 on December 29.

Experts attribute Helium Mobile’s success primarily to vertical integration.

Instead of selling bandwidth as a generic commodity, Helium Mobile launched a complete consumer product—combining hotspots into a mobile coverage network. The company manages the entire customer lifecycle, from device activation and billing to SIM cards and support.

This approach reshaped Helium’s economics. According to Messari, the mobile segment accounts for 53% of HNT token burns and internal Data Credits (DC) usage.

To maintain a deflationary model, Helium Mobile burns 100% of subscription revenue from its $15 and $30 monthly plans. While Helium Mobile Offload burns less HNT in dollar terms than similar centralized operations, the virtual mobile operator generates higher overall revenue.

On December 8, Helium Mobile Offload burned $6,700 worth of HNT, compared to $201,377 from carrier offload. Rather than competing for B2B bandwidth sales, Helium captures higher margins through a B2C model.

Rapid user growth alongside a steady increase in installed nodes confirms the company’s success.

As of December 29, 2025, Helium reported 622,000 registrations across 121,000 access points.

Optimism was further boosted when the SEC closed its investigation into Helium developer Nova Labs in April.

In December, Helium announced a partnership with Mambo WiFi to expand internet access across Brazil. Mambo’s network of over 40,000 access points will significantly extend Helium’s reach in a country with uneven connectivity.

Energy and AI Drive the Next Phase

The push toward creating differentiated products is becoming a new DePIN narrative.

One sector pioneer is Filecoin, the market cap leader at around $1 billion. Initially positioned as a decentralized cloud storage alternative, Filecoin announced Filecoin Onchain Cloud in November 2025—competing with Cloudflare and AWS.

The platform expands Filecoin’s capabilities, particularly in AI—integrating storage, data retrieval, and on-chain payments via Filecoin Beam and Filecoin Pay.

Amid recurring outages at centralized providers like AWS, DePIN’s evolution may attract renewed user and investor attention.

On November 18, 2025, during the latest Cloudflare incident, trading volumes in DePIN tokens surged 25–40% on average. Activity increased in FIL/USDT, AR/USDT, and GRASS/USDT pairs on Binance and Bybit.

Although volatility was short-lived, it signaled growing recognition of decentralized infrastructure’s value.

The shift toward enterprise clients is also evident in decentralized energy networks such as Daylight and Fuse Energy, which are building vertically integrated models.

Daylight focuses on renewable energy, installing solar panels and batteries while incentivizing users through future token rewards.

The startup connects distributed energy resources, accesses energy and data via its network, and sells differentiated energy products to buyers. In October, Daylight raised $75 million in funding led by Framework Ventures.

Another major player, Fuse Energy, operates across generation, retail sales, and virtual power plants within a unified system. Instead of selling capacity and data to third parties, Fuse manages its own ENERGY network to aggregate supply.

By using token incentives, Fuse significantly increases accessible flexible capacity while lowering acquisition costs—funding customer discounts and ecosystem rewards.

According to DePINscan, Fuse raised $70 million in a Series B round led by Lowercarbon Capital and Balderton Capital, valuing the company at $5 billion.

DePAI: The AI Opportunity

Messari analysts believe DePIN’s biggest opportunity lies in AI—specifically decentralized AI infrastructure, or DePAI.

While many solutions remain years away from enterprise-scale adoption, real-world data collection for robotics already has economic value. AI companies are willing to pay for:

-

navigation data;

-

video streams;

-

3D maps;

-

sensor logs;

-

telematics;

-

geospatial signals.

DePAI data-collection protocols can fill gaps in these areas, enabling near-term monetization.

Some existing DePIN networks already generate real revenue from data sales:

-

DIMO — vehicle telematics data;

-

Geodnet — geodetic sensor data;

-

ROVR — drone imagery and aerial photography.

These networks sell data directly to industries intersecting with physical AI training—mapping, navigation, geolocation, autonomous driving, simulation, and world modeling.

The next evolution stage is DePAI networks purpose-built for robotics-grade data capture and embodied AI training.

Three emerging projects stand out:

-

BitRobot — a decentralized embodied AI and robotics research platform on Solana;

-

PrismaX — a protocol aggregating high-quality multimodal interaction data and robotic sensor inputs for LLMs;

-

Poseidon — a full-stack data network focused on IP-clean, high-quality datasets with built-in consent, licensing, and provenance.

According to Messari, in 2025 DePIN occupied an uncomfortable middle ground for investors. Narrative-driven traders lost interest, while fundamental investors viewed price-to-sales multiples as excessive.

Still, improved transparency, sector development, regulatory easing, and token sell-offs could attract investor attention in 2026.

In this new environment, DePIN is well-positioned for its next evolutionary phase. Its defining traits—real-world utility, observable demand, and growing revenue—align closely with broader market direction. The open question remains execution: can DePIN networks continue scaling revenue and grow into large, durable businesses?

ES

ES  EN

EN