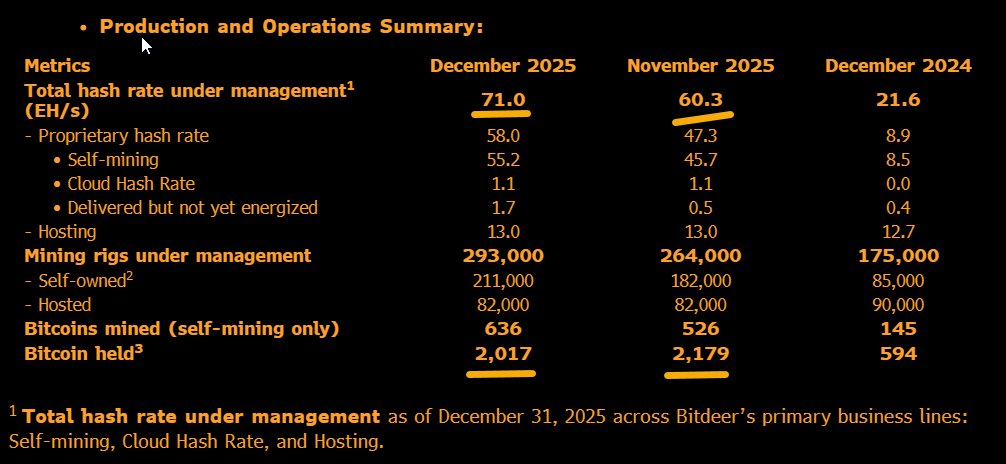

Of this figure, 55.2 EH/s comes from Bitdeer’s own mining operations, while the remaining capacity is allocated to hosting client-owned equipment.

By comparison, the hashrate of long-time industry leader MARA stands at 61.7 EH/s.

However, a direct comparison may be imprecise: Bitdeer reports total hashrate under management, while MARA discloses only connected mining capacity.

Bet on AI and asset sales

Bitdeer’s growth is linked to the deployment of its proprietary SEALMINER chips. In December 2025, the company mined 636 BTC, compared with just 145 BTC a year earlier.

The firm is actively selling its mined cryptocurrency. VanEck Head of Research Matthew Sigel noted that Bitdeer sells all newly mined coins and even part of its reserves to finance its AI-related initiatives.

Bitdeer combines bitcoin mining with the development of infrastructure for AI and high-performance computing. Its data centers are located in Canada, Ethiopia, Norway, and the United States.

Different strategies

Competitors are pursuing markedly different capital management strategies:

-

MARA follows an accumulation strategy. The company holds more than 55,000 BTC on its balance sheet—the second-largest bitcoin reserve among public companies after Strategy.

-

Bitdeer, by contrast, maintains minimal digital asset holdings, with reserves of around 2,000 BTC.

At the time of writing, Bitdeer shares were up 4.07% at $12.77

MARA shares gained 2%, reaching $10.93

ES

ES  EN

EN