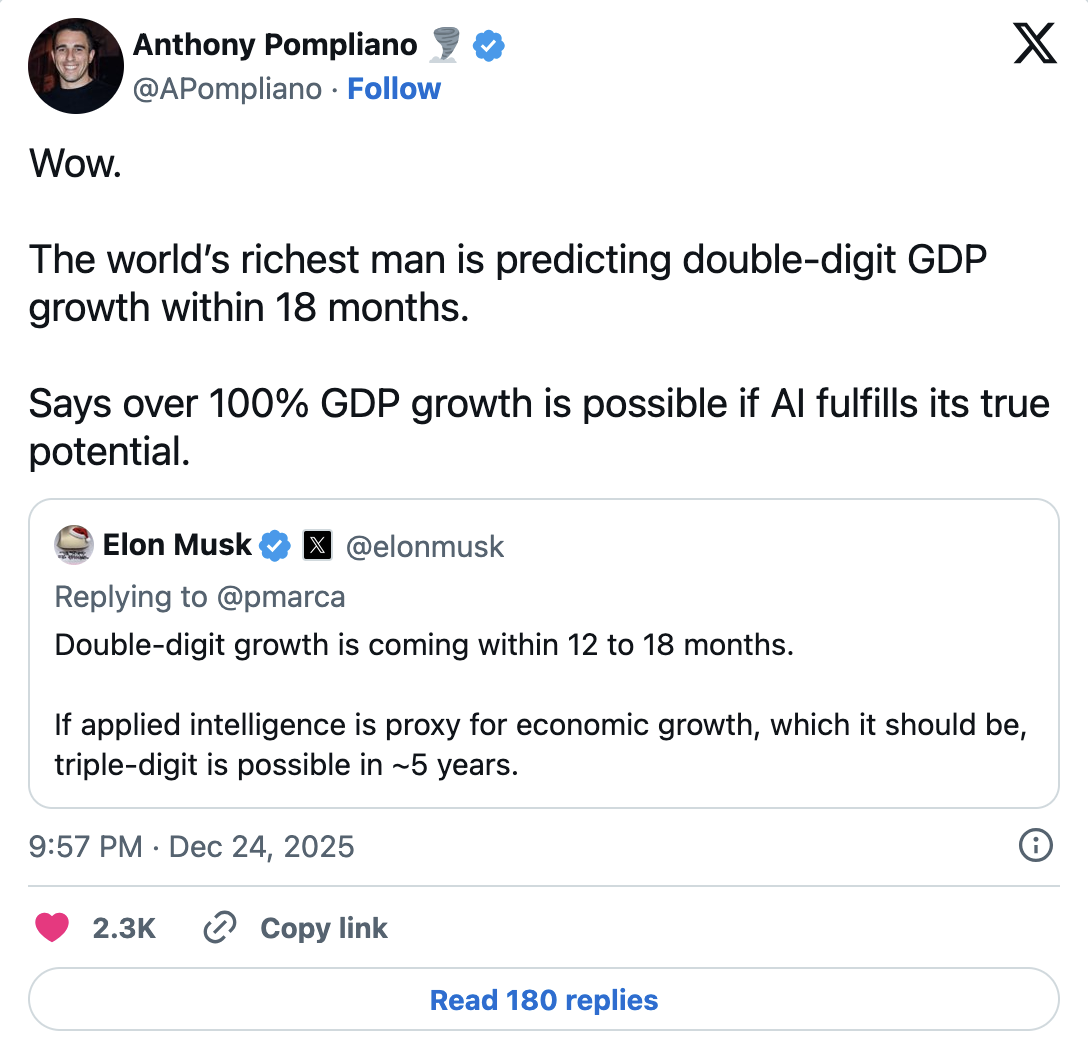

“If you treat applied intelligence as a proxy for economic growth — and I think that’s the right way to look at it — then triple-digit growth becomes possible in roughly five years,” Musk wrote.

Bitcoin entrepreneur Anthony Pompliano drew attention to Musk’s remarks.

“The richest person on the planet is forecasting double-digit GDP growth within 18 months and says growth above 100% is achievable if AI fully delivers on its potential,” Pompliano noted.

Representatives of real-world asset infrastructure provider Oryon Finance commented that “forecasts from someone with a broad, systemic view are rarely just random noise.”

Not everyone agreed with Musk’s outlook. Tech journalist and editor Artem Rusakovskiy argued that “predictions have never really been Musk’s strong suit.”

In November, Musk hinted that Tesla could unveil a flying car by the end of 2025. He said the company plans to release a new Roadster featuring “crazy technology” that could supposedly enable it to “fly.” He has also repeatedly promised fully autonomous driving for Tesla vehicles, although true Level 5 autonomy remains far off.

Implications for Bitcoin

Crypto market participants are closely watching macroeconomic signals that could influence digital asset prices. One of the most closely followed developments has been the Federal Reserve’s interest rate cuts.

Despite Musk’s bullish GDP forecast, some analysts remain skeptical about its implications for Bitcoin.

In December, veteran trader and technical analyst Peter Brandt emphasized that Bitcoin is a unique asset that has already gone through five parabolic rallies on a logarithmic scale, each followed by drawdowns of at least 80%.

According to Brandt, the current Bitcoin cycle has not yet fully played out, which leaves room for a potential decline toward the $25,000 level. He expects the peak of the next major bull market no earlier than September 2029.

ES

ES  EN

EN