The issuer plans to use the proceeds to complete construction of a data center focused on high-performance computing (HPC) services. The facility is located in Wink, Texas.

The capital will also allow Cipher to reimburse approximately $232.5 million previously provided to the subsidiary from its own funds under an internal credit facility.

Cipher Mining is acting as full guarantor of the debt obligations of its wholly owned subsidiary, Black Pearl.

In December 2023, Cipher completed the acquisition of the site for the Black Pearl facility, which initially offered up to 300 MW of grid connectivity. In June 2025, the company commissioned the site for Bitcoin mining, achieving a hashrate of approximately 2.5 EH/s using 150 MW of power. Capacity expansion was expected through the replacement of older equipment with newer models, including Canaan’s Avalon A15Pro.

At that time, Cipher operated five data centers with a combined capacity of 2.6 GW.

In the second half of the year, the company accelerated its diversification into the AI segment. In September, Cipher leased a data center in Colorado City, Texas, to UK-based startup Fluidstack. The deal was facilitated by Google, which received an equity stake in Cipher in exchange for $1.4 billion in guarantees.

In November, Cipher signed a $5.5 billion leasing agreement with Amazon Web Services (AWS) to support HPC services.

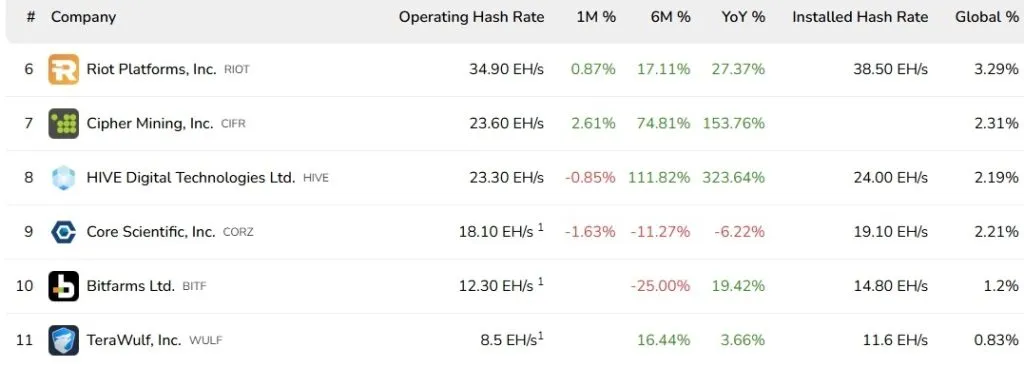

According to BitcoinMiningStock, Cipher currently operates a deployed Bitcoin hashrate of 23.6 EH/s, ranking seventh among publicly traded mining companies. Over the past 12 months, the firm has increased its crypto mining capacity by approximately 1.5×.

TeraWulf to Expand AI Capacity by 1.5 GW

Bitcoin miner TeraWulf is acquiring two facilities in Houseville, Kentucky, and Charles County, Maryland, which could add 1.5 GW to the company’s energy portfolio, bringing the total to 2.8 GW.

In Kentucky, the acquisition involves an industrial site with:

-

access to robust energy infrastructure;

-

480 MW of connected capacity;

-

potential for further expansion.

The site is located several hundred kilometers from major Midwest metropolitan areas, making it suitable for latency-sensitive workloads such as HPC, the company noted.

In Maryland, TeraWulf is acquiring an operational power plant with 210 MW of generation capacity. The initial reconstruction phase is expected to expand output to 500 MW, with a long-term target of 1 GW. The company added that load growth will be paired with expanded battery storage capacity to ensure uninterrupted power supply.

“The site’s proximity to the Washington, D.C. metropolitan area and other Mid-Atlantic markets increases its attractiveness for compute-intensive workloads where scale and reliability are critical,” the company said.

In August 2025, Google increased its stake in TeraWulf to 14% by expanding financial guarantees related to a deal between the miner and Fluidstack.

In September, TeraWulf announced plans to raise $3 billion through a Google-backed structure, with the funds earmarked for data center construction. TeraWulf’s installed Bitcoin hashrate currently stands at 8.5 EH/s, representing approximately 16.5% growth year over year.

Conclusion: Bitcoin miners are increasingly repurposing their facilities into AI and HPC infrastructure. Access to cheap power and existing data-center capacity gives them a clear opportunity to diversify revenues, but it also demands heavy capital investment and deepens dependence on large partners such as AWS and Google.

ES

ES  EN

EN