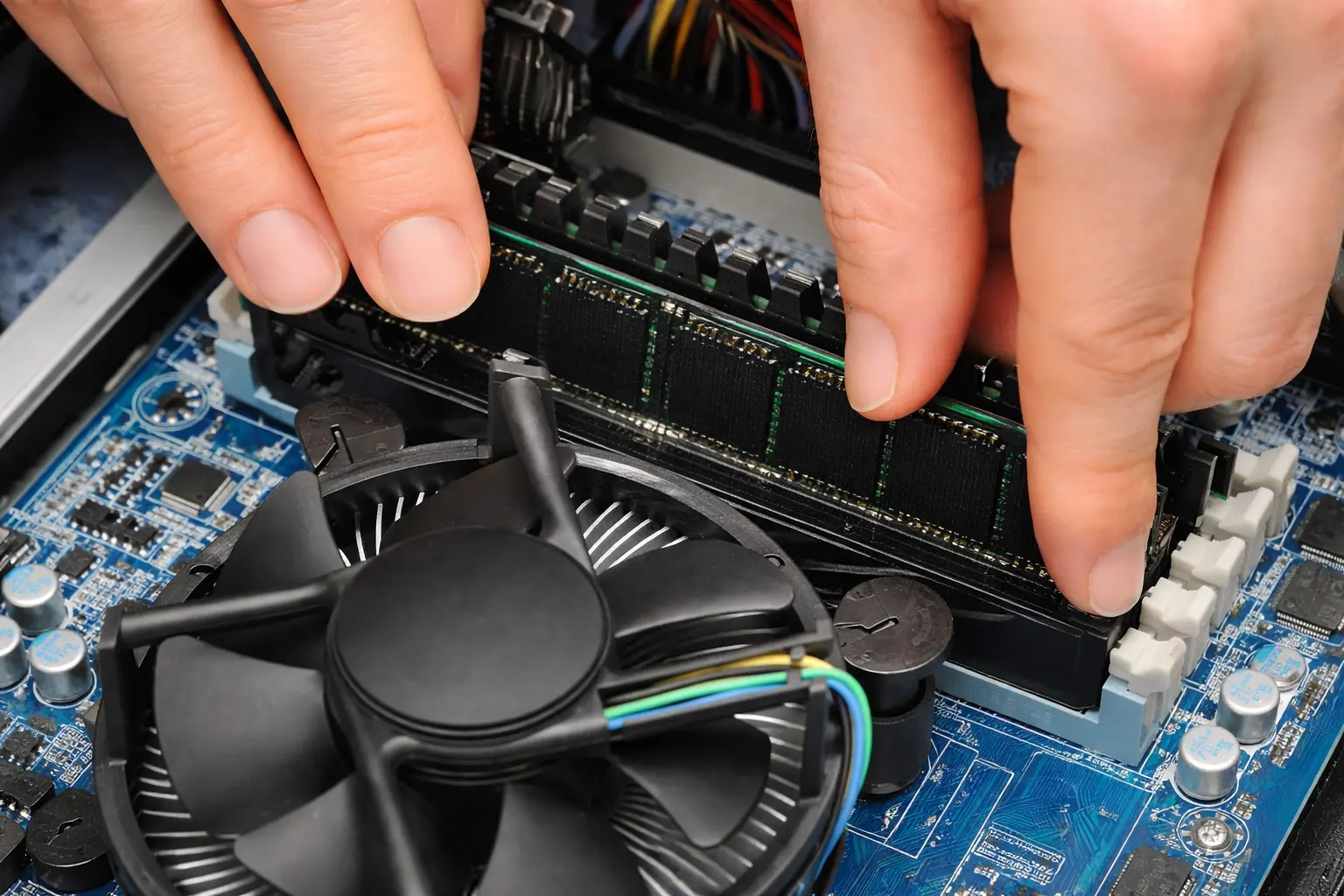

Arm CEO Rene Haas said the current memory shortage is the most serious he has seen in more than 20 years. Samsung co-CEO Tae Moon Roh also called the situation unprecedented and warned that consumers will inevitably feel the impact. Qualcomm CFO Akash Palkhiwala described the shortage as “quite dramatic,” attributing it to the rapid buildout of data centers by “five or six companies with massive capital expenditures.”

Throughout 2025, companies such as Google, Amazon, Meta, and OpenAI announced multibillion-dollar investments in new data centers to support AI models and products. As a result, memory manufacturers Samsung, SK Hynix, and Micron have redirected capacity toward these high-margin customers, deprioritizing memory used in consumer devices like smartphones and laptops. Micron has gone as far as winding down its consumer brand, Crucial.

Analysts at Morgan Stanley expect most memory suppliers to raise prices significantly in the first half of 2026. This could lead to weaker sales of Android smartphones and Windows-based PCs. According to International Data Corporation, Chinese manufacturers in the low-end smartphone segment are likely to be hit hardest.

Apple and Samsung are in a stronger position thanks to long-term supply agreements that secure key components up to two years in advance.

Outlook: The memory crunch underscores how AI infrastructure is crowding out consumer electronics at the supply-chain level. Unless new capacity comes online faster than expected, higher device prices and slower unit growth look likely through 2026, reinforcing a shift toward premium vendors with stronger supplier leverage.

ES

ES  EN

EN