“Mining was effective under our previous business strategy, but over time it became a less profitable use of capital compared to opportunities that allow us to actively participate, generate yield, and apply operational leverage,” said CEO Sam Tabar.

He added that the company has consolidated its digital assets into Ethereum and is now focusing on AI infrastructure through its stake in WhiteFiber.

“These decisions have repositioned Bit Digital into areas we can operate, monetize, and scale over time,” Tabar noted.

Bit Digital began mining Bitcoin in 2020. In 2022, it briefly mined Ethereum before the network transitioned to Proof-of-Stake, after which the company began accumulating and staking ETH.

The firm was among the first in the industry to diversify into high-performance computing (HPC). Anticipating market trends, it launched Bit Digital AI in 2023.

In June 2025, Tabar signaled the possibility of a full exit from Bitcoin mining. Over the following months, the company sold off mining assets, terminated hosting contracts, and shut down outdated equipment.

At the same time, Bit Digital expanded its presence in AI and HPC through subsidiaries and partnerships. In August 2025, its affiliate WhiteFiber raised nearly $160 million in an IPO.

“WhiteFiber represents our long-term commitment to AI infrastructure. We view this ownership as a core strategic asset within our capital allocation strategy,” Tabar wrote.

ETH accumulation

As of July, Bit Digital held 153,546 ETH, worth $419 million at current prices, with the majority staked. According to The Block, the company’s mNAV ratio stands at 1.93, meaning BTBT shares trade at a 90% premium to the net value of its ETH holdings.

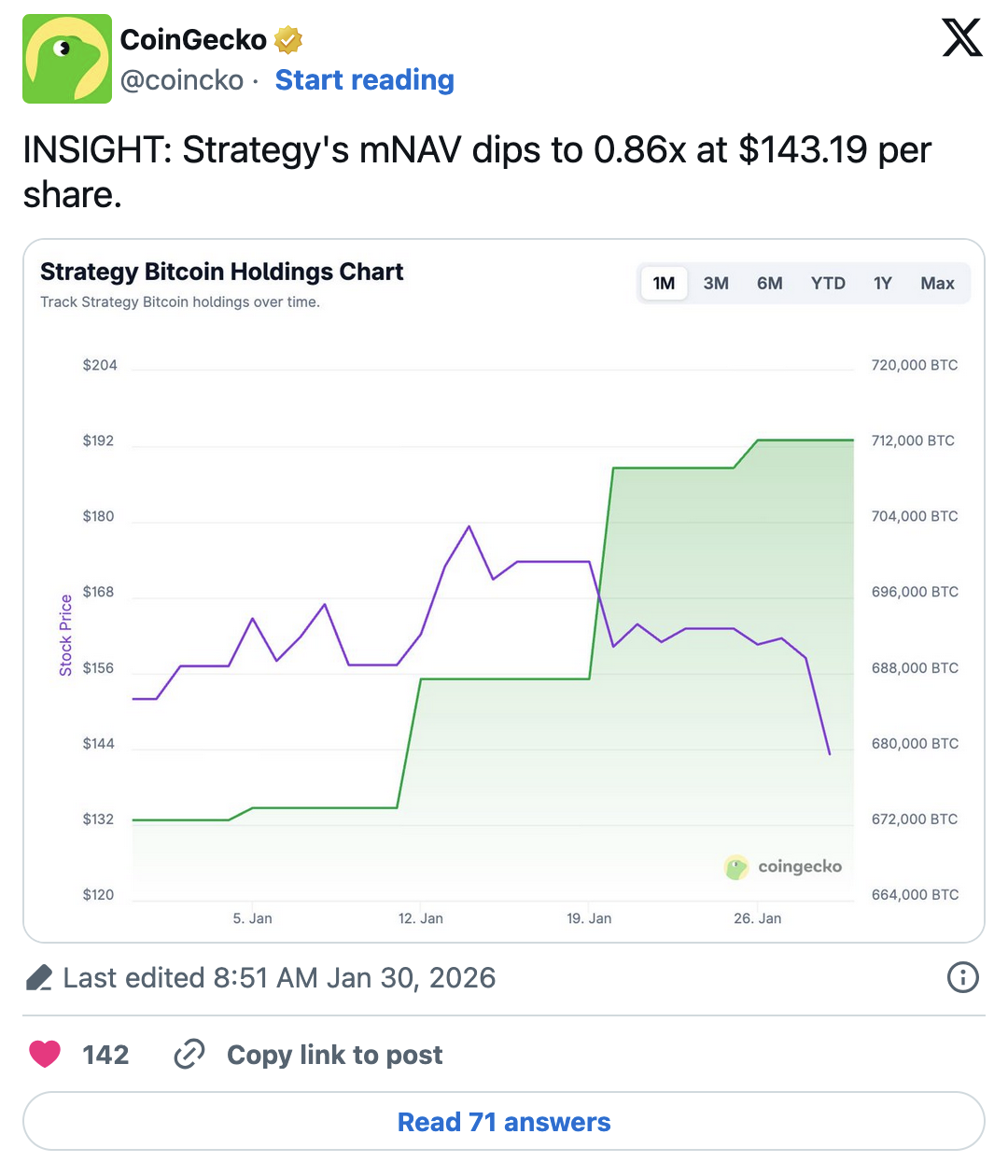

For comparison, MicroStrategy’s comparable metric has fallen below 1.0 (0.86) amid a decline in its stock price.

In October, Bit Digital additionally purchased 31,057 ETH, using proceeds from a $135 million convertible bond offering.

Miners shift toward AI

The pivot toward AI and HPC has become an industry-wide trend. By November, 7 of the 10 largest publicly traded miners reported revenue from these segments.

Diversification is proving economically attractive. For example, TeraWulf’s AI contracts generate annual revenue of $1.85 million per megawatt, significantly outperforming traditional mining.

Stable cash flows and higher profitability have become key advantages driving miners to embrace AI-focused strategies.

ES

ES  EN

EN