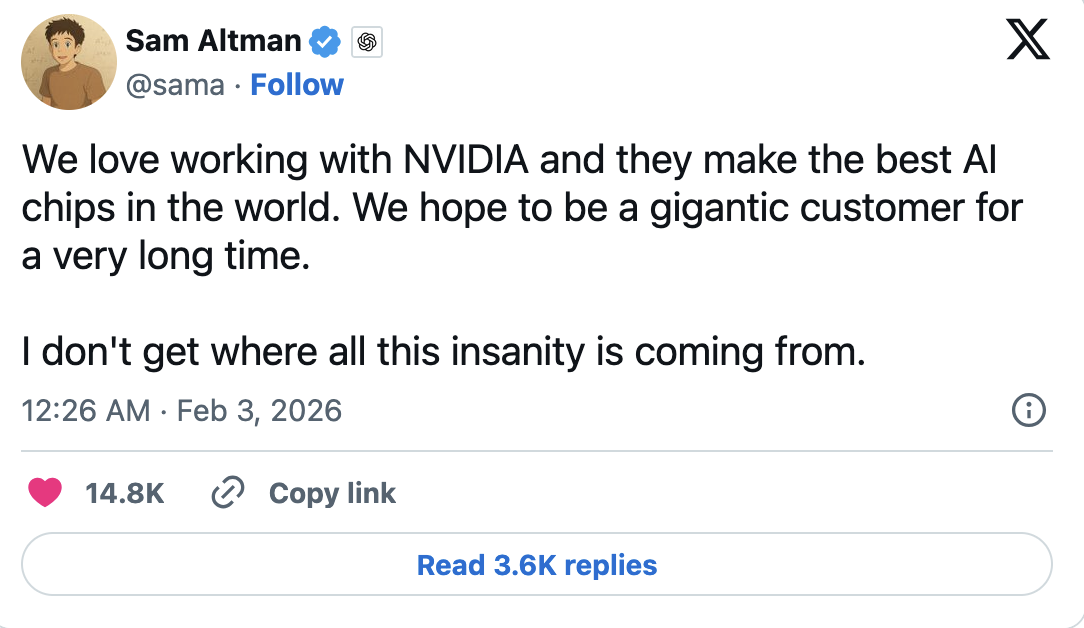

Following a Wall Street Journal report suggesting tensions between Nvidia and OpenAI, both OpenAI CEO Sam Altman and Nvidia CEO Jensen Huang moved to play down speculation.

“We love working with Nvidia, and they make the best AI chips in the world. We hope to be a huge customer for a very long time. I don’t understand where all this madness is coming from,” Altman wrote on X.

In a video interview, Huang said that there had never been a binding commitment for a $100 billion investment, referring to the deal discussed last September. OpenAI had invited Nvidia to invest that amount, which Huang called an honor, but emphasized that Nvidia would invest “step by step.”

Update: January 31, 2026

Nvidia CEO Jensen Huang calls the upcoming OpenAI investment “probably the largest we’ve ever made”

Huang confirmed that Nvidia will invest in OpenAI, but at a level well below the $100 billion figure previously mentioned in September. He did not disclose an exact amount, but told reporters in Taipei that it would “probably be the largest investment we’ve ever made.”

OpenAI is currently seeking to raise up to $100 billion in total. Amazon is also reportedly in talks, according to Bloomberg, about an investment of up to $50 billion.

January 31, 2026

Nvidia reportedly puts $100 billion OpenAI deal on hold

The mega-deal between OpenAI and Nvidia announced last September is now reportedly on hold. According to the Wall Street Journal, Nvidia CEO Jensen Huang has privately expressed doubts about OpenAI’s business approach.

The $100 billion deal has not progressed beyond early stages, despite OpenAI initially expecting to finalize the agreement within weeks of the September 2025 announcement. Huang has reportedly stressed to industry partners that the original agreement was non-binding and has privately criticized what he sees as a lack of discipline in OpenAI’s business strategy, while also raising concerns about competition from Google and Anthropic.

Both sides are now reassessing the future of their partnership. Recent discussions reportedly involve a multi–tens-of-billions-dollar equity investment as part of OpenAI’s current funding round.

Warning signs had already emerged in December, when Nvidia CFO Colette Kress confirmed at a conference that no final agreement existed. Potential revenue from the OpenAI deal was not included in Nvidia’s $500 billion revenue outlook.

Competition from Google and Anthropic increases pressure on OpenAI

While Google’s Gemini app still trails ChatGPT by a wide margin, it has shown growth, and Anthropic’s Claude Code is also increasing competitive pressure.

Despite this, Huang reportedly still believes it is important to support OpenAI financially, not least because the startup is one of Nvidia’s largest customers. If OpenAI were to fall behind other AI developers, Nvidia’s revenues could be affected. At the same time, OpenAI is also working on its own AI chips to reduce dependence on Nvidia.

An OpenAI spokesperson told the Wall Street Journal that teams are “actively working on the details” of the partnership. A Nvidia spokesperson said the company has been OpenAI’s preferred partner for over a decade and looks forward to continued collaboration.

Original announcement promised the “largest computing project in history”

In September 2025, OpenAI and Nvidia announced a memorandum of understanding to build at least 10 gigawatts of computing capacity—roughly equivalent to the output of ten nuclear power plants.

Under the plan, Nvidia was expected to invest up to $100 billion to support financing, while OpenAI would lease the chips. Huang at the time described the initiative as “the largest computing project in history.” Nvidia’s stock rose nearly 4% following the announcement. OpenAI is reportedly targeting an IPO by the end of 2026.

Conclusion:

The evolving Nvidia–OpenAI relationship underscores both the scale of ambition and the growing uncertainty in the AI infrastructure race. While Nvidia appears ready to make what could be its largest-ever investment in OpenAI, the shift away from the once-touted $100 billion figure highlights caution around execution, competition, and long-term business discipline. As OpenAI seeks massive funding and explores custom chip development, and Nvidia balances customer support with strategic risk, the partnership is moving from headline-grabbing promises toward a more incremental, pragmatic model—one shaped as much by market realities as by technological vision.

ES

ES  EN

EN