A fresh survey of 100 CIOs from large enterprises shows that OpenAI is still in the lead, but its advantage is narrowing as Anthropic and Google gain momentum. Microsoft, meanwhile, continues to dominate the enterprise AI applications layer.

Rather than evolving into a fragmented landscape with many comparable vendors, the enterprise AI market is consolidating around a small group of powerful players. In other words, an oligopoly is forming.

These findings come from Andreessen Horowitz’s (a16z) third annual CIO survey, which interviewed executives from Global 2000 companies with at least $500 million in annual revenue. a16z itself is an investor in OpenAI.

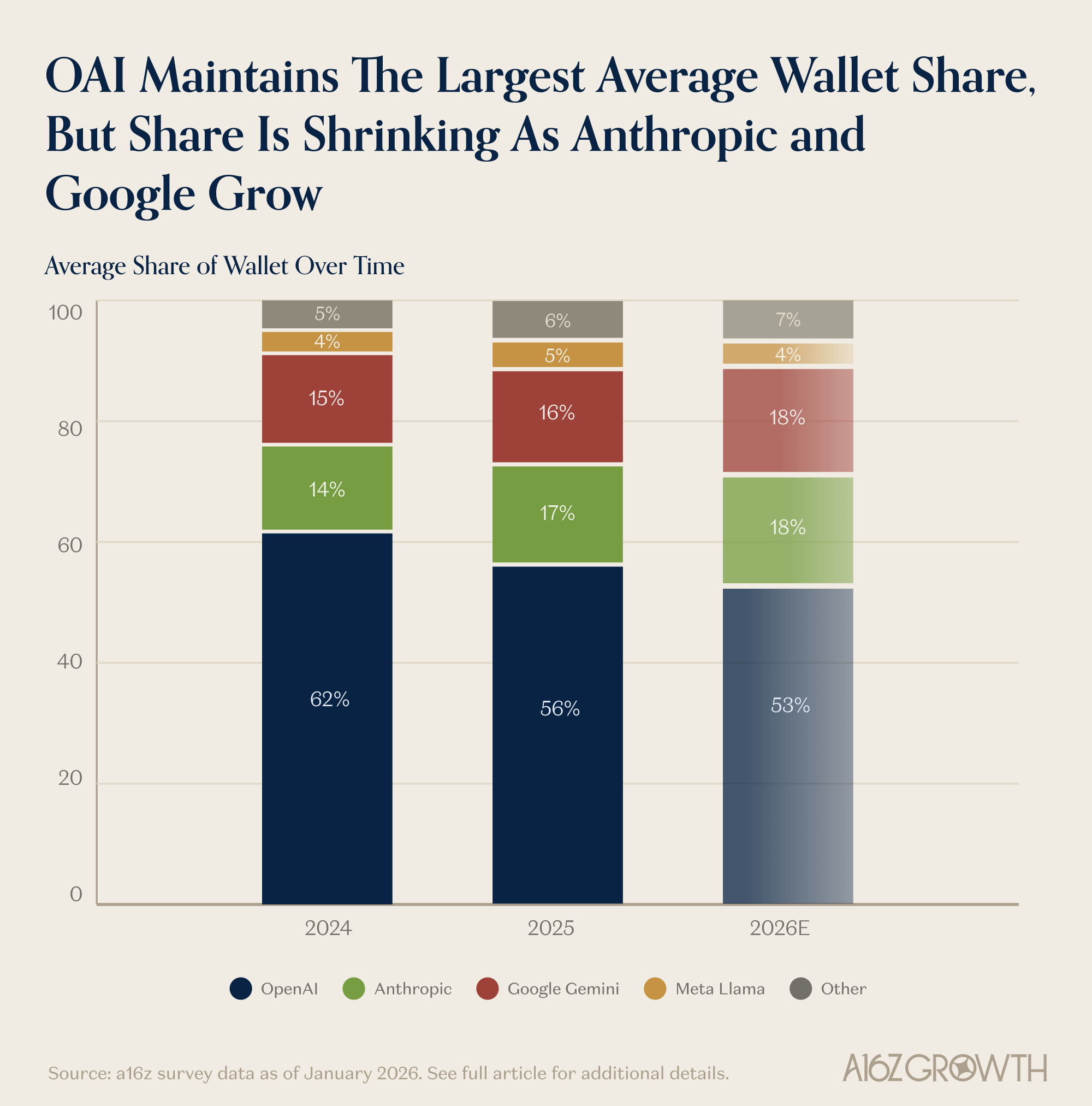

Today, 78% of surveyed companies run OpenAI models in production. Anthropic recorded the fastest growth: since May 2025, its enterprise adoption climbed 25 percentage points to 44%. OpenAI still accounts for roughly 56% of total enterprise spending on AI models, but CIOs expect this share to erode. By 2026, spending is projected to split roughly as follows: OpenAI 53%, Anthropic 18%, Google 18%.

Proprietary models gain trust in enterprise

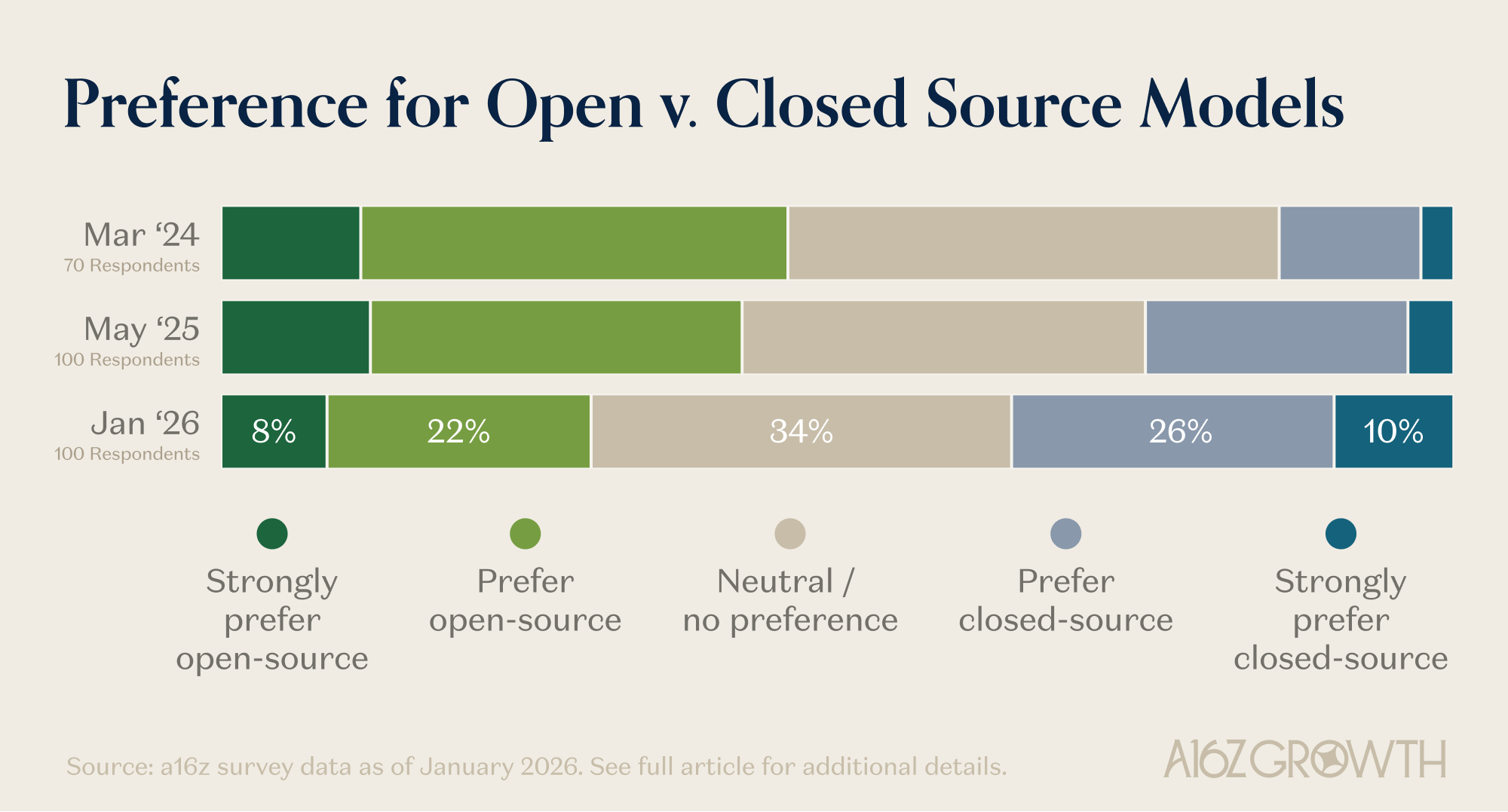

The long-anticipated open-source takeover has yet to materialize in large organizations. Instead, more than one-third of enterprises now favor closed, proprietary models, and that preference is growing. CIOs point to faster iteration cycles, shortages of in-house AI talent, and stronger data-security guarantees as key reasons. Trust in frontier labs such as OpenAI and Anthropic has increased significantly over the past two years.

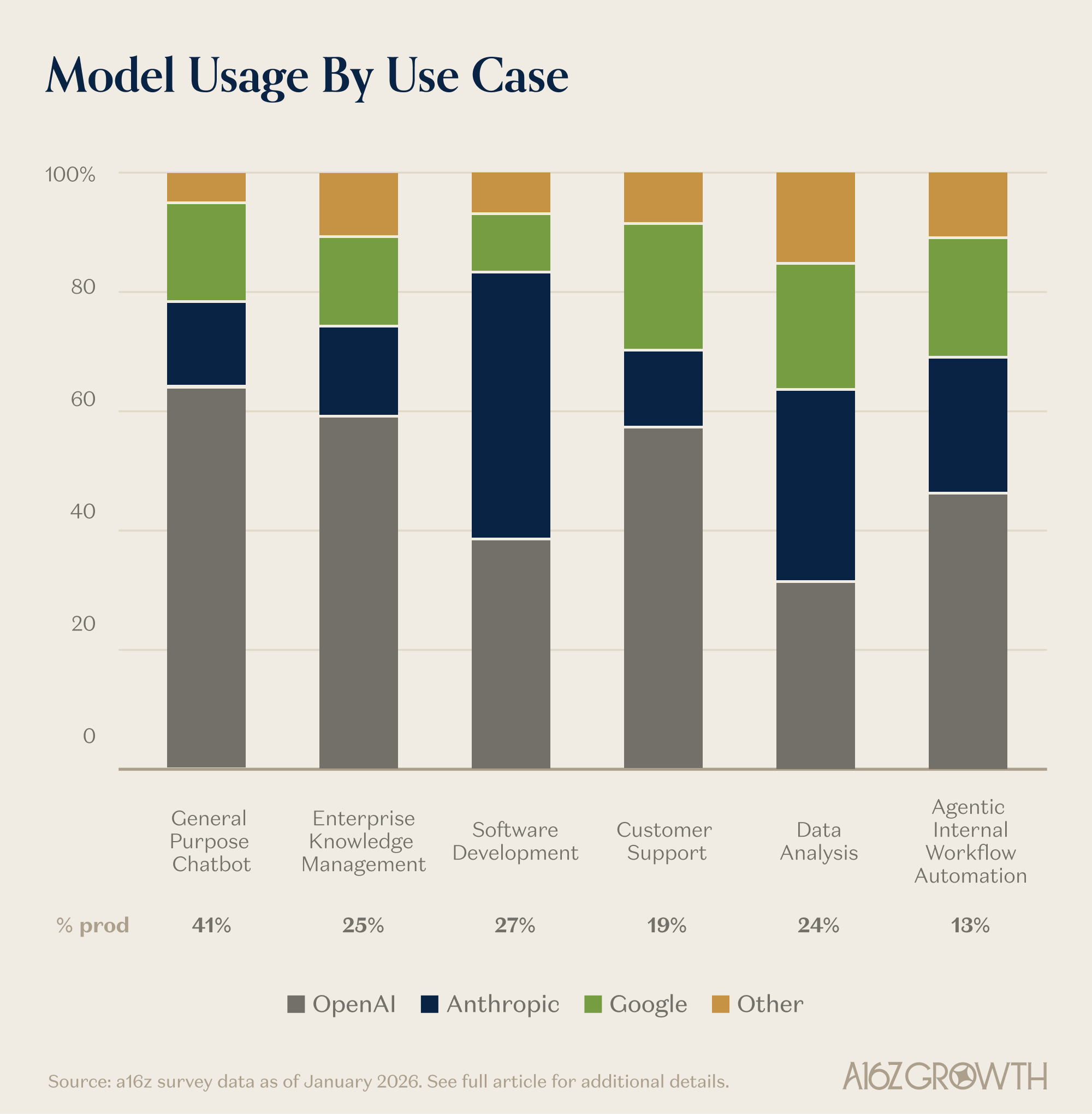

Different leaders for different use cases

Market leadership depends heavily on the task. OpenAI remains strongest in broad, horizontal use cases like general chatbots, enterprise knowledge management, and customer support. Anthropic has carved out a lead in software development and data analysis, driven by rapid capability improvements since late 2024. Google’s Gemini performs well across many domains but consistently trails in coding-heavy workflows.

One factor behind Anthropics’s rise is how quickly customers move to its newest models. About 75% of Anthropic users already deploy Sonnet 4.5 or Opus 4.5 in production. By contrast, only 46% of OpenAI customers are on the latest GPT-5.2 or 5.2 Pro, with many enterprises sticking to older models that still meet their needs.

Multi-model strategies are now the norm: 81% of companies use three or more model families, up from 68% less than a year ago.

Microsoft owns the application layer

On the application side, Microsoft is the clear winner. Microsoft 365 Copilot leads enterprise chat with paid adoption above 90%, while GitHub Copilot remains the dominant AI coding tool at around 74% penetration. Other platforms—such as Salesforce Agentforce, ServiceNow AI Agents, Google Workspace, and Workday AI—lag behind, though several show strong evaluation-stage interest.

Overall, 65% of enterprises prefer buying AI solutions from established vendors, citing trust, deep integration with existing systems, and smoother procurement. Still, a16z notes that startups can compete where AI-native products deliver meaningfully faster innovation.

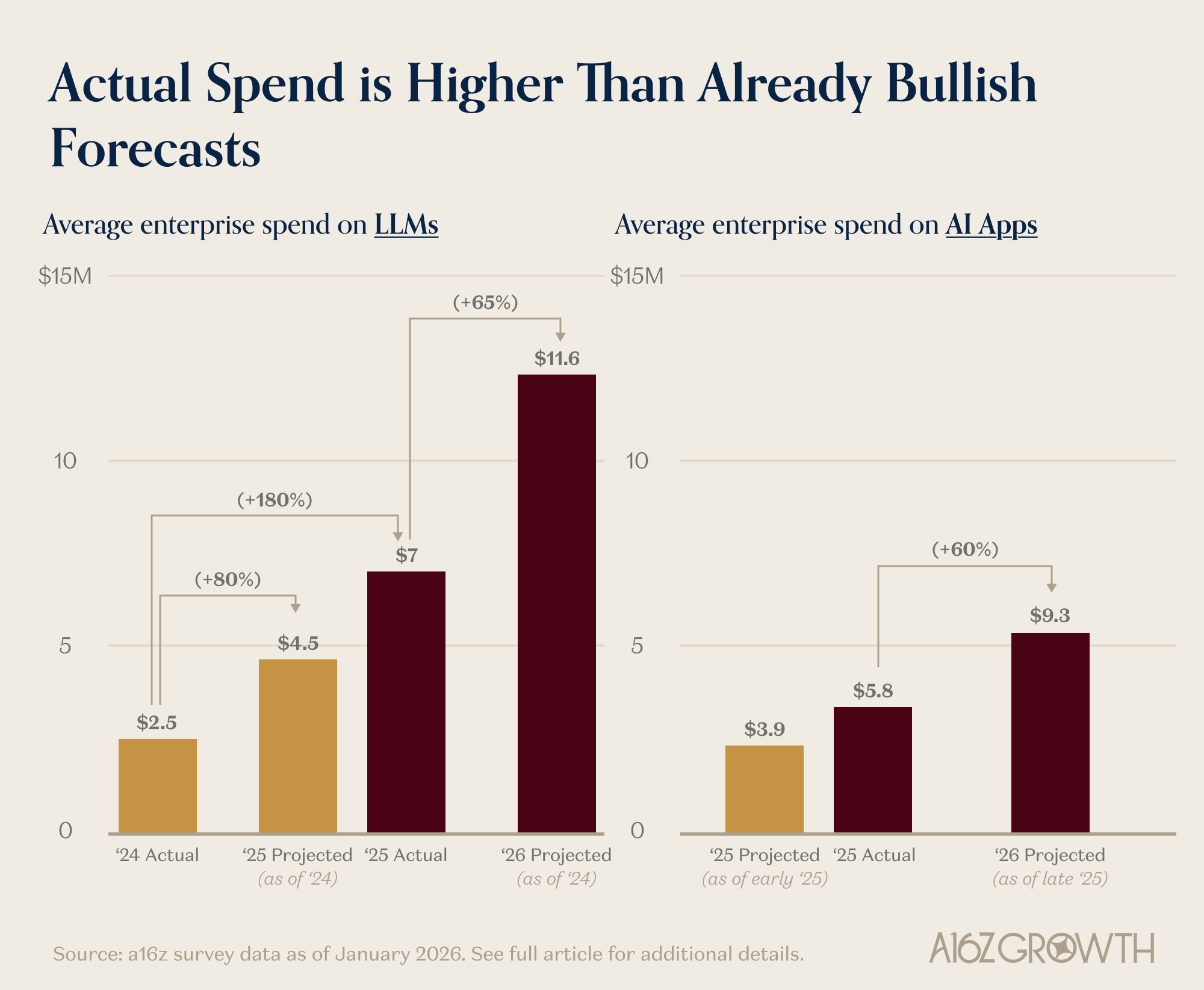

AI budgets are expanding faster than expected

Enterprise spending on large language models is accelerating well beyond earlier forecasts. Average annual LLM spend rose from about $2.5 million in 2024 to roughly $7 million in 2025, a 180% increase versus an expected 80%. For 2026, CIOs anticipate another 65% jump, pushing average spend to around $11.6 million

ES

ES  EN

EN