The update will make it possible to discover digital assistants and their services without relying on centralized infrastructure. Agents will also gain platform-independent reputation, allowing trust to be established across ecosystems.

ERC-8004 enables verification of:

- who an AI agent is;

- what it has done previously;

- whether it can be trusted.

These changes will unlock a global marketplace for AI-based services, where agents can interact with one another without intermediaries.

Under the ERC-8004 proposal introduced in August 2025, each agent receives a unique identifier within a dedicated registry smart contract. This ensures compatibility with existing infrastructure and allows assets to be transferred between owners.

Trust models for AI agents are categorized by security levels — ranging from low-risk tasks like ordering pizza to high-risk use cases such as medical diagnostics.

The official activation date has not yet been announced. However, Marco De Rossi, co-author of the standard and head of AI at MetaMask, pointed to January 29, 2026 as the expected launch date.

“Ethereum occupies a unique position as a platform that provides security and settlement for interactions between artificial intelligences,” said Davide Krapis, Head of AI at the Ethereum Foundation.

Identity, reputation, validation

ERC-8004 introduces a system of three registries designed to verify and enhance trust in AI agents. The solution is compatible with both Ethereum mainnet and Layer-2 protocols.

The identity registry assigns each agent a portable, censorship-resistant identifier. Compatibility with NFT standards allows assistant profiles to be easily transferred between different applications.

The reputation registry provides an interface for signed client reviews, effectively creating a public rating system for digital assistants.

The validation registry enables auditing: agents request verification of their actions, while validators record results directly on the blockchain.

The future of payments

The crypto community is actively discussing a future in which AI agents manage finances — executing transactions, purchasing goods, and operating autonomously.

Ethereum co-founder Vitalik Buterin believes that within the next 5–10 years, AI will process “a large volume of micropayments.” However, he cautions that full automation for large transfers remains too risky.

“AI is easy to attack. But for small payments, it’s suitable. It can also serve as a risk-management tool for large transfers — checking whether a $100,000 transaction looks suspicious. I think we’ll gradually discover the right ways to combine AI and payments. There will be successes — and mistakes,” he explained.

Paxos has identified AI agents as a potential growth driver for the stablecoin sector. According to co-founder Bhavu Kotecha, market fragmentation across jurisdictions and various pegged-token models could be solved through digital assistants.

Algorithms can instantly switch between platforms and assets, selecting the most favorable execution conditions.

“This means fragmentation doesn’t necessarily act as a constraint — it can become an optimization layer at the market level, where AI directs liquidity flows toward the most efficient issuers. Over time, this could reduce fees and force providers to compete on fundamentals,” Kotecha said.

Galaxy Digital CEO Mike Novogratz expects that “in the not-so-distant future, neural networks will become the largest users of stablecoins.” Consumers will be able to delegate everyday purchases and bill payments to AI agents, while software executes transactions.

Investor and Shark Tank star Kevin O’Leary believes AI and blockchain will ignite the “next business revolution.” AI will autonomously conduct retail purchases, while distributed ledger technology will process payments.

Infrastructure for the AI economy

To support the emerging AI-driven economy, new payment solutions are already being developed.

Coinbase, the largest crypto exchange in the US, launched Payments MCP, allowing language models such as Anthropic’s Claude and Google’s Gemini to access crypto wallets, fiat gateways, and payments.

PayPal will integrate the Agentic Commerce Protocol (ACP) along with OpenAI’s Instant Checkout, enabling purchases directly through ChatGPT.

ACP is an open standard that allows merchants to list products inside AI apps, while users make purchases through AI agents.

Instant Checkout, launched in September, enables order confirmation, delivery selection, and payment without leaving ChatGPT.

In late October, Quack AI introduced x402 BNB — a “unified layer for signatures, payments, and governance in the agent economy on BNB Chain.” The tool replaces multiple steps with a single cryptographic signature: confirmation → transfer → payment.

x402 BNB “solves protocol-level friction,” enabling “one-click, gasless transactions that are verifiable, auditable, and controllable.”

Ethereum isn’t earning — yet

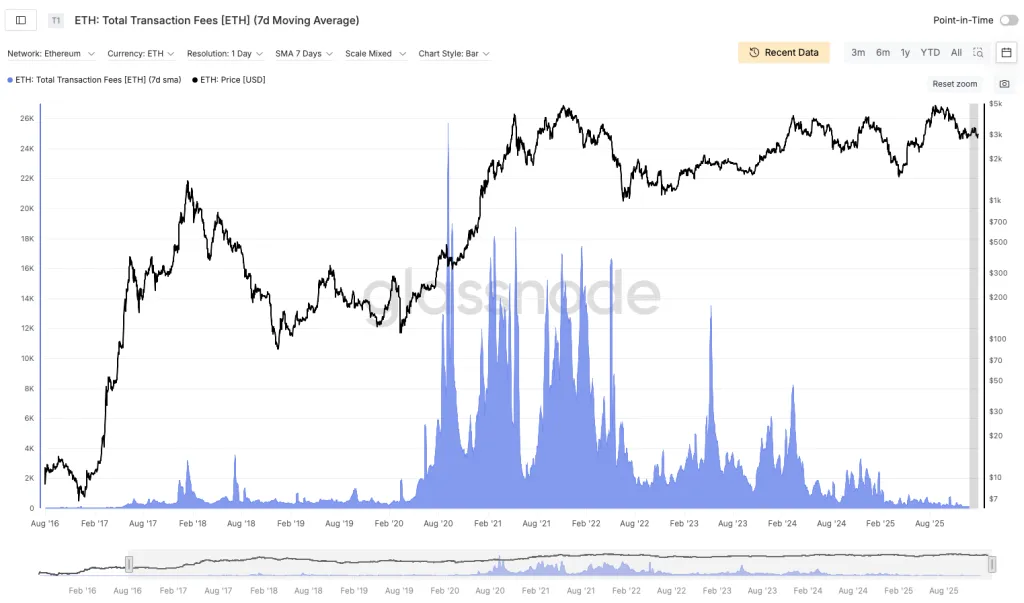

Ethereum network fees have fallen to their lowest level since May 2017.

This is not due to declining activity. In January, Ethereum recorded an all-time high in transaction count. The seven-day moving average approached 2.5 million transactions, double last year’s levels.

The sharp surge in on-chain activity began in mid-December following a prolonged slump. Recent scalability upgrades played a major role:

- Activation of the Fusaka upgrade in early winter;

- The Blob Parameter-Only fork on January 7, which raised the per-block blob limit from 15 to 21.

ES

ES  EN

EN